Digital insurance is the shorthand term used to refer to digital transformation trends within the insurance industry. Put simply, it’s the use of digital technology to make improvements to processes, products, or services by insurance providers.

The story of digital transformation in the insurance industry is a happy one— insurance is one of the sectors where the benefits of digital adoption are clear, and the value of digitalization has already been demonstrated.

However, that doesn’t mean progress in digital insurance is slowing down. On the contrary, digital innovation in insurance is getting faster.

In this article, we’re sharing everything you need to know about digital insurance to arm you with the knowledge to keep up with the competition.

Better yet, we’ll be sharing strategies for how to drive digital transformation in your insurance business, so you can begin using technology to give you an edge over your competitors.

The current landscape of digital insurance

Digital insurance provides customers with more personalized, convenient, and cost-efficient insurance services.

A 2022 study by Accenture found that 64% of equity analysts say that technology modernization is one of the most important cost transformation levers for insurers today— which highlights how most insurers already understand the importance of digital transformation.

The forerunners of this movement have been dubbed “InsurTech”— companies that use digital technologies like machine learning (ML) and artificial intelligence (AI) to disrupt the status quo.

In doing so, InsurTech companies empower consumers to interact with insurers in smarter and faster ways.

In turn, this enables InsurTech businesses to shorten the time for policy processing and improve customer experience, leading to greater customer satisfaction. According to Mckinsey, automation can reduce the cost of a claims journey by as much as 30%.

InsurTech startups are also revolutionizing how insurers assess risk and construct innovative products. They optimize insurance processes through better data analytics, resulting in cheaper premiums with fewer restrictions.

With insurtech startups continuing to disrupt the old status quo of the insurance sector, the onus is on traditional insurance providers to develop new business models if they intend to keep up.

The benefits of digital insurance

Digital insurance comes with a host of benefits for everyone involved, from customers, to policymakers, to regulators.

Understanding these benefits is essential if you want to create a business case for digitalization.

There are too many benefits for us to reasonably include here, so we’ve compiled a short list of the benefits we think are most compelling. These are

More efficient processes

By digitalizing processes, You can shorten the time taken for policy processing.

This leads you to more efficient operations and better customer experience.

Offer personalized products and services to customers

You can use digital technology like Artificial Intelligence (AI) and Machine Learning (ML) to provide more personalized services based on a customer’s preferences.

This is a great way to improve customer engagement, which in turn positively affects your Customer Lifetime Value (CLV).

Speed up communication

This benefit has two sides— communication with customers and communication with colleagues:

- Customers – By leveraging new technologies and opening digital channels (like mobile apps and online portals), you can increase your response rates in terms of customer communication, creating a better digital experience.

- Colleagues – Better tools and training increase organizational agility and speed up communication internally. The Inherent Problem describes how the biggest waste of time in an organization is the requirement of leadership to approve decisions. Faster communication is the best way to combat this.

Creating better digital experiences for your employees is also the best way to foster a culture where they embrace change.

As we’ll see later, this is an important strategy for successful digital transformation.

Shorter Time-To-Market (TTM)

Digital transformation enables insurers to develop innovative insurance products faster than before by minimizing paperwork and relying on digital processes.

This helps create better insurance products that solve customers’ problems more quickly.

Keeping up with regulatory requirements

Digital transformation is the key to helping you stay competitive and compliant with regulations.

By applying digital tools strategically, you can create an agile system that allows your business to quickly respond to changes in the market or new regulations.

This contributes to increased effectiveness and higher customer satisfaction levels, opening up further opportunities for driving growth.

4 key elements of digital insurance

The breadth of technologies that make up the digital insurance landscape is vast.

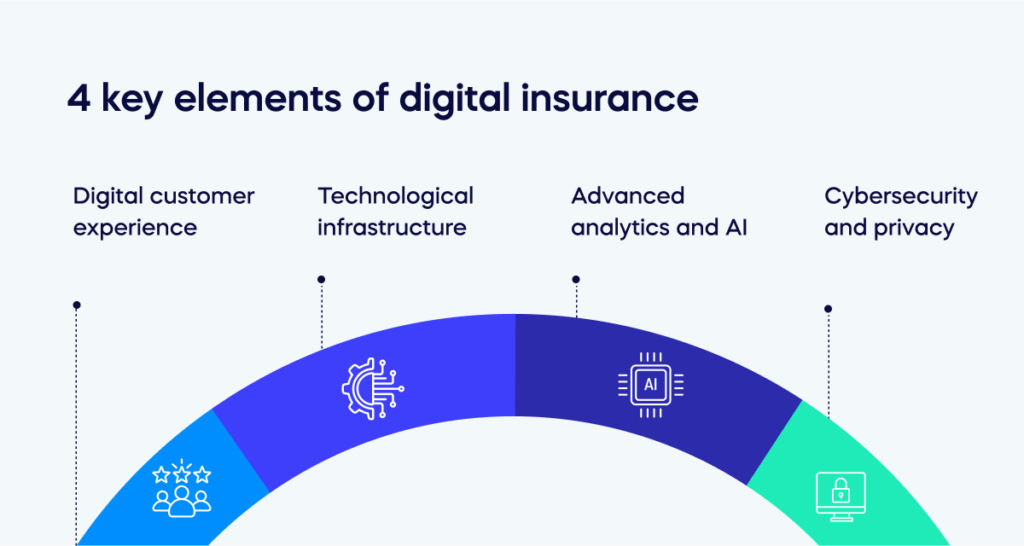

To help you wrap your head around it, you can consider all these technologies to belong to one of these 4 key elements:

- Digital customer experience

- Technological infrastructure

- Advanced analytics and AI

- Cybersecurity and privacy

Let’s drill down into each of these elements and explore some common examples of digital technologies you could use to drive improvements.

Digital customer experience

These are digital tools that improve the customer experience by optimizing efficiency, convenience, or cost.

Focusing on the customer experience is a proven way to drive innovation and growth, and these are the most common technologies digital insurance providers use to achieve that end:

Multi-channel distribution

With consumers becoming more tech-savvy, insurance companies need to keep up by offering multi-channel distribution.

This means being available across a variety of digital platforms including websites, mobile applications, social media, and even chatbots.

By meeting your customers where they are, you can make purchasing policies, filing claims, and seeking customer support as straightforward and accessible as possible.

Customer relationship management (CRM)

Personal CRMs can help insurance companies manage their customer interactions more effectively.

This includes gathering and analyzing customer data to offer personalized experiences, identifying potential sales opportunities, and improving overall customer satisfaction.

Automated reminders, personalized messages, and more immediate responses to queries are just a few of the ways that digital CRM tools can help you enhance customer relations.

Technological infrastructure

Your technological infrastructure is all of the technology that allows your business to do what it does.

Bolstering it with digital tools improves business continuity planning, employee productivity, and employee experience.

Here are a couple of the digital tools that provide the foundation for innovation in this space:

Cloud-based systems

By leveraging cloud technology, you can store vast amounts of data, streamline operations, and quickly deploy new applications.

Cloud-based systems also support a remote work environment, improve disaster recovery capabilities, and allow for scalable growth.

Blockchain technology

Blockchain offers significant potential for the insurance industry.

It can be used for smart contracts, reducing the risk of fraud, enhancing transparency, and streamlining claims processing.

Smart contracts automate the insurance claims process, triggering payouts when certain conditions are met. This not only reduces processing time but also minimizes human error.

Advanced analytics and artificial intelligence

The ability to collect and analyze vast amounts of data is crucial in the digital insurance industry.

Advanced analytics and AI can help insurance companies to understand risk more accurately, streamline the claims process, and tailor products to individual customer needs.

AI can also automate routine tasks, freeing up human resources for more complex tasks.

Cybersecurity and privacy

As the insurance industry becomes more digital, it also becomes a larger target for cyber threats.

Protecting customer data and ensuring privacy is paramount. You need robust cybersecurity measures to prevent data breaches and to build trust with customers.

Digital cybersecurity technology is the best way to protect yourself and your business from malefactors.

Challenges and risks in digital insurance

While digital adoption in the insurance industry has been a clean-cut success, we’d be remiss not to inform you of the challenges you may face.

Some of the issues, like technological challenges, are the same that you’d face in any industry.

But some challenges are specific to the insurance sector, like the regulatory and privacy issues you must consider at every step.

Let’s elaborate on some of these challenges:

Technological challenges

Adopting new technologies is not a straightforward process, especially in an industry as traditional as insurance.

There are significant technological challenges that you may need to overcome.

For instance, integrating new technologies with existing legacy applications can be a complex and resource-intensive task.

There’s also the need for continued digital innovation to keep pace with rapidly evolving digital trends.

Insurance companies must also tackle the lack of tech skills within their organizations, which requires substantial investment in training and development or in new hiring.

Regulatory issues

Insurance is one of the most heavily regulated industries, and the digitalization of insurance processes introduces new regulatory challenges.

Existing laws and regulations may not cover new digital insurance products or practices, leading to uncertain legal terrain.

In some cases, regulators may be slow to catch up with technological changes, which can limit the adoption of digital insurance.

In other instances, the regulations may vary by country or state, making it hard for you to scale your digital operations.

Keeping up with the changing regulations and ensuring compliance in such a complex environment can be difficult and costly.

Ethical and privacy concerns

Ethical and privacy concerns are among the most pressing issues in digital insurance.

The increasing use of data analytics and AI in decision-making processes can lead to concerns about fairness and transparency. For instance, algorithms might be biased, leading to unfair pricing or claims decisions.

On the privacy front, digital insurance requires the collection and analysis of vast amounts of personal data, which can raise serious concerns.

If improperly handled, sensitive customer data could be at risk of exposure, leading to breaches of trust and potential legal repercussions.

Thus, you would need to maintain a delicate balance between leveraging data for business benefits and respecting customers’ privacy rights.

Ensuring robust data protection measures and being transparent with customers about how their data is used are crucial steps in addressing these concerns.

Implementing a digital insurance transformation strategy

If you want to boost the digital maturity of your insurance company, we recommend working through the following three stages.

The idea behind these stages is to help you first identify the low-hanging fruit— these digital transformation initiatives are easier to implement but will have a bigger impact on your business.

As we move through the stages, things get more complicated, more technical, and less reactive— it becomes more about proactive changes.

Stage 1: Evolution

The first thing you need to do is update and digitize your core systems.

This can begin with evolution— updating old, manual processes to better match the needs of the business today.

That might mean updating IT infrastructure or using Robotic Process Automation (RPA) to streamline manual processing.

You could also set up an omnichannel contact center that allows your customers to personalize how they interact with your business.

Actions you should take:

- Review existing processes to identify areas for improvement.

- Research new technologies such as RPA and omnichannel solutions.

- Implement solutions and monitor performance.

- Make adjustments as necessary to stay ahead of the competition.

Stage 2: Maturation

Maturation means using technology like blockchain, big data, predictive analytics, and others to optimize processes for maximum efficiency and drive business growth.

Rather than updating old processes to catch up to the market, you’re now using emerging digital technologies to innovate.

Ask how these cutting-edge tools could allow you to offer new insurance products or services. Consider how they could add value for your existing customers.

Stage 3: Optimization

incorporate artificial intelligence and machine learning into your system to supercharge data analytics and make automated decisions quickly based on real-time data.

Push this even further by graduating to predictive analytics to inform decision-making proactively.

Now you’re focused on the finer points— perfecting customer experiences and pushing the envelope of what your competitors think is possible.

The future of digital insurance

Emerging technologies continue to shape the future of digital insurance.

The Internet of Things (IoT), for example, offers significant potential for risk prevention and management. IoT devices, such as smart home sensors or telematics in cars, can collect real-time data, allowing insurers to assess risks more accurately and offer personalised premiums.

Moreover, 5G technology, with its enhanced speed and reduced latency, will enable real-time data transmission and analysis, making insurance processes even more efficient.

Artificial Intelligence and Machine Learning will continue to evolve, providing further opportunities for automation and advanced data analytics.

Meanwhile, technologies like blockchain could help improve transparency and reduce fraud in the insurance process.

The digital transformation of the insurance industry is an ongoing process.

Insurers will need to continually adapt and evolve to keep pace with technological advancements, changing consumer expectations, and regulatory changes.

Despite the challenges, the future holds exciting opportunities for those who are prepared to innovate and embrace the potential of digital insurance.

Companies that are customer-centric, data-driven, and agile are likely to lead the way, shaping the future of insurance in the digital age.