Many people enter healthcare management with bright visions of what they can achieve for the health system, intending to change lives and support those who save them. Whether this is your first job in the role or you’re already a seasoned professional, the gap between the vision and the reality of being a healthcare manager can make the first year a real challenge.

With every passing year, legal and financial risk management become obstacles ever-increasing in size and complexity for various health systems. And then your organization must compete for patients against larger neighboring hospitals, often with more significant financial resources.

For these reasons, high-quality care with the lowest expenditure is difficult to achieve. But fear not, working in health systems is not all doom and gloom. Effective healthcare budgeting is possible using our comprehensive and detailed capital expenditures budgeting example and best practice guide. Let’s define some terms to kick things off, starting with capital expenditure budgets.

What Is A Capital Expenditure Budget In The Healthcare Management Industry?

It’s easy to get caught up in the language of financial concepts, but the best way to see a capital expenditure budget is like a wallet and a grocery shopping list. You have a certain amount of cash needed to get groceries in the wallet. You only have a limited amount of money in your wallet, but you need to get every grocery on the list to feed yourself. If you go over your budget, you will be in trouble and have to borrow money from the bank.

Now put this in the context of managers ensuring enough money exists to care for patients or managers of a company seeing what care is available depending on need. Because of the many different types of treatments and their varying costs, along with health insurance providers with differing charges, budgeting becomes a bit more complicated than buying bread and milk.

However, our comprehensive example described later makes formulating a capital expenditure budget in healthcare management seem much more manageable for any healthcare manager, no matter the organization’s size.

Why Is A Capital Expenditures Budget Needed In The Healthcare Industry?

Healthcare organizations have three budgeting processes: Operational budgeting, capital budgeting, and rolling forecasting. Capital budgeting involves paying for new infrastructure, maintenance, and other physical goods like new technologies and beds.

The reason for planning this budget carefully in healthcare is that care is so costly that the more spent means, the fewer patients can receive care. However, if the equipment is not up to date and there aren’t enough beds purchased, the resources are not available to care for many patients. Healthcare managers need to strike this balance within a well-planned capital expenditures budget.

What Expenditures Are Part Of A Capital Budget For Healthcare Organizations?

Capital expenses for healthcare organizations are part of the running costs, supplies, and maintenance. The budget can involve high-cost supplies such as technological medical equipment or low-cost consumables like bandages and sterile water. The healthcare manager can separate expenses into several categories, the first of which is operational budgeting.

Operational Expenses

Operational budgets involve the expenses of the day-to-day running of a hospital or clinic. These materials are needed to perform the actions expected by patients. These expenses also involve information technology such as software. This budget is a high priority because, without it, the organization would not be able to function at a basic level. Depending on the specialism of the organization, this can involve:

- Cotton swabs

- Fluid bags

- Alcohol wipes

- Sterile and non-sterile gloves

- Software as a Service (SaaS)

- A cloud-based platform

These items are essential to invest in for basic levels of care practice. Conversely, capital expenditures involve investments into high-cost equipment to meet more specialized care needs and building maintenance.

Capital Expenses

Capital budgeting differs from operational budgeting in that it caters to more significant expenses that are used for many years and reduce in value over time. Specialized technological equipment is an example of what would be included by the manager of a capital budget. More specific examples of this can include:

- Messenger RNA (mRNA) Technology

- Virtual Reality (VR)

- Artificial Intelligence (AI)

- Robotic process automation (RPA)

- Telemedicine

- Health wearables

- New infrastructure projects

- Present infrastructure maintenance

These capital expenditures help provide quality care at a certain standard compared with other healthcare organizations. The best practice is that the budget manager measures each expense against data analyses conducted to prove its long-term value, ensuring it is a prudent investment.

Rolling Forecasting Expenses

Rolling forecasting differs from the first two types of expenses as it involves not buying large or small goods but predictions. Rolling forecasting is the act of predicting trends in the future that externally affect a healthcare organization. Examples of events that the healthcare manager needs to react quickly to include:-

- Covid-19

- Availability of drug materials for a variety of regional reasons affects supply.

- Policy changes such as Obamacare.

Rolling forecasting expenses may appear less important than the other two in the maintenance and operation of a hospital or clinic. In reality, forecasting could be considered the most important of the three due to its value in helping to plan provisions for the future within the unstable economic and political environment of US healthcare.

If a healthcare organization does not care for patients adequately due to a lack of resources following poor prediction of trends and market changes, they may face litigation from patients or challenges from Quality Improvement Organisations (QIOs).

Healthcare managers must employ rolling forecasting to mitigate financial risks to healthcare organizations, just like nurses on a ward manage patient risks. Nurses prevent patients from falling, and healthcare managers avoid a hospital or clinic from being tripped up by a lack of funding due to a lack of adequate profit.

Financial Planning In The Healthcare Management Industry

Healthcare managers must create robust, future-proof financial plans to accommodate the three types of budgets. Healthcare managers prioritizing the right areas and correctly balancing department budgets according to the needs of the specific hospital or clinic is key to success. Managers must cover key regions to ensure the most organized and effective financial management.

Evaluation and planning

Managers usually conduct evaluation and planning, which involves evaluating the organization’s effectiveness and maintaining operations. These actions allow the organization to plan for the future for unforeseen events or react to current or past events. For example, a small hospital may lose revenue to a neighboring hospital with several MRI scanners. The smaller hospital may use a truck with a mobile MRI scanner, but other small hospitals share this, so it is not always available. In buying their own MRI scanner, the small hospital capitalizes on the need for MRI scans for potential patients.

Long-term investment

Managers from all departments are responsible for decisions on long-term investments, despite the healthcare hierarchy in finance. Managers assess long-term investments on the potential for positive or negative outcomes and everything in between. Returning to our MRI example, managers weigh the long-term investment in a permanent MRI scanner against the number of patients likely to need it. The result might vary depending on the time of year and the patients who previously used the mobile truck MRI scanner. The cost of the scanner would then be set against the potential increase in revenue and lead to a decision-making outcome.

Financing decisions

Administrators significantly influence financial decisions, but managers conduct planning alongside administrative teams. Managers use benchmarking to learn from other healthcare organizations and set comparative metrics to hit realistic targets. Another technique is an exact, high-performing budgeting process. This act involves basing the budget on performance and giving low-performing departments more attention and support.

Accountability becomes a more expansive part of healthcare management every year. Hospital managers collaborate with department managers and the finance team to cascade learning, spread the responsibility, and for efficiency. Placing a burden on the department to control its budget makes accountability part of the approach to every task from the top down. Accountability also creates a system that pressures departments, increasing their focus on responsibility as they must hit targets in certain areas for funding approval.

The balance between quality, profit, best practices, and customer satisfaction is critical. For many reasons, managers tracking and managing expenses are the best way to track funding variances. During Covid-19, the spending on non-sterile rubber gloves and face masks increased. By monitoring this variance, hospital managers can choose cheaper suppliers to meet demand without hurting profits.

Working capital management

Cash is the most liquid asset of any business, including hospitals and clinical services. Any manager must know what they can liquidate quickly and sell for the hospital’s long-term benefit and sustainability. Within this, basic accounting terms must be familiar to the hospital manager, such as accounts receivable (AR), which involves money owed to the organization. Inventory is another critical term referring to the stock of supplies needed and ensuring there is not too little or too much. And finally, accounts payable (AP) refers to the amounts of money that need to be paid by the hospital to suppliers of goods or services.

Contract management

Healthcare managers have contracts with many suppliers of goods and services, and communication must be vital for maintaining good relationships.

Financial risk management

Risks are everywhere in an environment where people’s lives are in your hands. These risks affect all departments differently, making financial risk management a complex task for healthcare managers. Like many aspects of a manager’s role, the risk of death and harm means they need a basic understanding of the legal frameworks within a hospital’s remit.

Financial planning for risks is an essential skill for managers in which to excel. What could happen if we build the extension to ER? Will we lose patients? Can we keep a section of ER still open? What if the project exceeds the time frame? Managers need to ask these questions and use the answers to formulate a contingency plan for every eventuality to decrease financial risks before the manager makes any commitment to investment. Managers also need to be aware of legal contacts for the hospital should the need arise.

All healthcare systems in the US are affected by employer private insurance or Medicare. Managers must have in-depth knowledge and follow changes in insurance plans from different providers and how government policy informs health insurance. Insurance becomes part of all practices for healthcare providers, including the capital budgeting process.

Types Of Capital Budgeting Process In The Healthcare Management industry

The three capital budgets fill very different parts of a hospital or clinic’s strategic vision. Above all, rolling forecasting is often ignored but is essential as it influences the entire budget of the hospital. The manager must consider all three types of funding for financial success. The first of these is operational budgeting, relating to the everyday running of the hospital.

Operational Budgeting

Financial planning for operational budgets involves the operating costs of running healthcare organizations. Examples are consumables like bandages or software used by the information technology department of larger hospitals. The best questions to ask when formulating the operational budget are:

- What do we need?

- How much can we spend?

- How much do we currently spend?

- Are there cheaper alternatives?

- How can we assure value and safety?

Managers and leaders in financial teams must travel far and wide and, as often as possible, speak with frontline staff and bring item samples to get the most out of the operational budgeting process. Once the healthcare manager has collected as much data and first-hand experience from different suppliers, the decision-making process should occur with the approval of frontline staff.

Healthcare managers’ collection of product samples, staff feedback, and being data-driven ensure that the highest quality items and technology, from software to surgical equipment, are provided for the highest efficiency and safest patient care practices. Such collaboration also shows that healthcare organizations invest in staffing in their practice at every level.

Capital Budgeting

Healthcare managers engaging in the capital budgeting process are considering much higher value items that reduce in value over time. Think MRI scanners and other large pieces of high-tech equipment with specialized functions. When making a capital budget, managers must ask similar questions as the manager asked for the operational budget. However, the capital budgeting process involves much more long-term assets. The questions to ask are:-

- Do we need this equipment, or is there a way of loaning it?

- What equipment will we need in the future? Should we begin financial planning?

- Will we need more of this type of equipment in the future?

- What are the different financing options for this equipment we need?

- Is employee training in place already so staff can use the equipment when it arrives?

- What if this purchase goes wrong and the manager overestimates the need for supplies?

The capital budgeting process is a financially risky yet essential type of budgeting process within healthcare. Patients need current technology, yet such technology is expensive. Managers must ensure adequate research on the necessity for equipment and that they understand all regulatory requirements and legal considerations before purchase.

Rolling Forecasting

Managers engaging in rolling forecasting make updates to operational and capital budgets. Healthcare managers need due diligence as a vital part of the skills necessary for this budget, as they will use historical data to predict future trends and industry shifts. Rolling forecasting also affects cash flow as demand changes due to external factors such as Covid-19. According to the most recent Deloitte study on healthcare, various Covid-19 pandemics have informed healthcare customer behavior in many ways.

- Many people are canceling non-Covid appointments due to fear of catching Covid.

- Healthcare staff is experiencing much higher stress levels, increasing sickness absence, with 55% reporting burnout.

- Telework for doctor-to-patient interactions is increasing.

The managers of hospitals and clinics need to be aware of these changes to ensure sustainability. Canceled appointments mean lost revenue. Sickness means panic, lower staff morale, and potentially lower patient care safety. Remote contact with patients means investing in new confidential, easy-to-use software and training staff to use it. The managers of hospitals and clinics need to be aware of these changes to ensure sustainability.

All these factors cost money, and lost revenue is always a concern. However, managers can avoid these losses by keeping their fingers on the pulse of the rapidly changing healthcare environment.

Solutions For Effective Change In The Healthcare Management Industry

These days, change is an essential tool in every industry, including healthcare. The magnitude of the challenges for change in healthcare is that it is very costly due to the time taken to discuss the change, purchase equipment or software, and then train staff in time to safely carry out the change. The final and most challenging part is convincing the team that the change is necessary, safe for them and their patients, and makes their jobs easier.

How healthcare managers use change management theories and frameworks differs from those used by managers in other industries. This difference is due to the large size of some healthcare organizations and the complex matrix of stakeholders with vastly different views.

For this reason, emphasis should be on balancing the implementation of change with human psychology and ensuring all stakeholders feel valued. Such flexible juggling of different values and aims for stakeholders requires strong change leadership in deciding on the best change management model. The first we will look at is Kotter’s eight-step model.

Kotter’s Eight-Step Model

In a study by the National Library Of Medicine, managers used Kotter’s Eight-Step Model in nineteen organizations, more than twice that of any other change model. This model helps implement change in healthcare organizations as it is task-oriented, which appeals to many health organizations. The model includes eight steps.

1. Motivate the team by creating an environment filled with a sense of urgency.

2. Build a guiding coalition, including all the right staff to plan, coordinate and carry out the change.

3. Establish a clear vision and each accompanying change initiative.

4. Enlist a workforce of volunteers driven toward the same goal.

5. Identify any challenges or obstacles.

6. Break goals into bite-size chunks and communicate successes little and often.

7. Maintain momentum, and push harder after every successful implementation.

8. Maintain the new culture to ensure changes don’t dissolve over time.

One factor to be aware of is that Kotter did not design this model for healthcare environments. Healthcare managers should be mindful that Kotter’s eight-step model is intensive and could lead to high rates of staff burnout, something healthcare staff are already at risk of even before a change plan. Therefore, Kotter’s change management theory model is best for significant, drastic change within a change management strategy, where massive change needs to be accomplished by a company quickly.

Short-period change management strategies carried over a few months work well with this model. One example could be a change in an ER unit, which is a high-pressure, task-oriented environment. Although burnout here could be high, staff may be more pragmatic and see improvements quickly, reducing staff stress and increasing patient care quality over the time they implement the changes.

Lewin’s Three-Stage Model Of Change

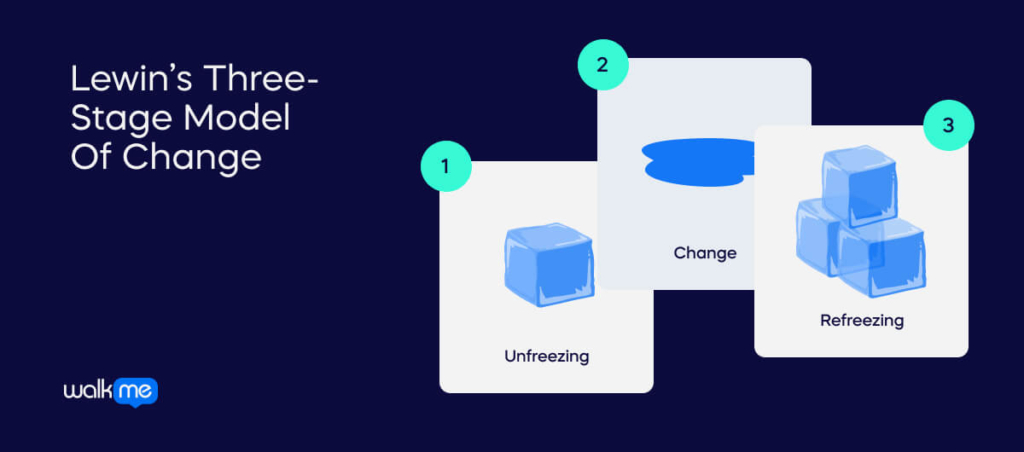

Lewin’s Change Management Model uses three steps to achieve change. It is helpful for short-term, intensive changes due to the aggressive top-down approach in the way it aims to achieve change through three stages:

- Unfreeze

Preparation stage. Look at how things operate to see the resources needed for the desired results. Communication is essential in this phase, as team members must be aware of what changes need to happen to prepare them for the subsequent steps.

- Change

Implementation stage. Project leaders set changes into motion, and communication is of high significance. Support must be available via communication channels. Implement required skills of staff needed for change.

- Refreeze

Develop a strategy to ensure change sticks. Analyze the effect of the new changes and measure how close you are to achieving goals set at the unfreeze phase. This phase is part of an ongoing process to achieve success.

Healthcare managers should use this theory alongside a softer model for longer-term change management strategies, but for short-term wins, this model can be perfect for achieving change quickly. Leaders must bear in mind that without a softer model monitoring employee experience to some level, adverse effects on employee retention and performance may occur due to burnout.

ADKAR Analysis

ADKAR (Awareness, Desire, Knowledge, Ability, Reinforcement) analysis is vastly different from the first two models as it focuses on understanding the emotions and thoughts of the people affected by the change. In healthcare, many stakeholders are affected by changes with different ways of gaining or losing.

ADKAR has the potential to collect feedback that managers can use to show different stakeholders how each is affected and the flexibility to adjust changes to everyone’s advantage. There are five steps to achieving an ADKAR analysis; the first is creating awareness for healthcare staff.

Step 1: Awareness

Show healthcare staff what changes are necessary and why. Managers need to give as much detail as possible when explaining changes, along with details of any training. Face-to-face announcements and training are preferred so staff can ask questions to enable them to participate early in the process.

Step 2: Desire

Create a desire to be supportive of the change to create an environment in which employee engagement increases so much that attitudes toward change become positive organically. At this stage, dialogues could occur between stakeholders and adjustments made to each stakeholder group’s satisfaction.

Step 3: Knowledge

Ensure adequate support is available for employees. Training, coaching, and checklists provided by the business are some types of support.

Step 4: Ability

Ensure employees, relatives, and patients can give feedback about their change journey. Leaders of change, such as project leaders or healthcare managers, must record and action this to provide the best opportunity for learning and development. At this point, healthcare managers make further adjustments to the change plan based on the feedback.

Step 5: Reinforcement

Use rewards and cash or holiday incentives to employees and other means such as championing staff who embody shared values. Also, the PR or HR team can implement an internal advertising campaign to remind everyone of the changes based on their feedback. These actions ensure that the new status quo is maintained.

Of all the change management tools in this list, the ADKAR model is the model most focused on human experience and supporting staff to naturally engage with new ways of fulfilling their role. For this reason, the ADKAR model can be effective for long-term change strategies within large or small teams. It can be beneficial in healthcare environments due to the many stakeholders of different professions with competing goals.

How Can Digital Tools Be Leveraged In The Healthcare Management industry?

Digital tools and digital adoption form the core of any business today and are at the center of change strategies. Healthcare is no different, but digital tools are even more essential in this industry. Digital resilience leads to higher quality patient care, more lives saved, and an improved reputation, resulting in more significant revenue.

When patients feel engaged in their care, they will be more satisfied with care outcomes. In contrast, a lack of leveraging digital tools can lead to low safety levels of care and a lack of innovation, leading to low revenue. Patient engagement should therefore be the focus when leveraging technology.

Patient and Family Portal

A patient and the relative portal can make it easy for these stakeholders to communicate with healthcare professionals in a way staff can manage easily. This technology improves staff, patient, and relatives’ relationships, reducing conflicts and challenges when patients feel out of the loop.

Mobile Healthcare systems

According to the healthcare society HIMSS, wearables can improve patient outcomes. Wearables recording measurements such as blood pressure support high-quality data acquisition and are inexpensive. Patients can remain comfortable at home while data is recorded and sent to healthcare systems in hospitals. All stakeholders can gain.

Video Conferencing

Video conferencing is an excellent midway between seeing a healthcare professional face to face and over the phone. With Covid-19 still a threat to patients and healthcare staff, video conferencing is a crucial tool in quality care from a safe distance.

Benefits Of Effective Budgeting & Strategic Communication In The Healthcare Management Industry

When healthcare systems draw up effective budgeting processes and strategic communication, it is always worth the investment if done correctly. Budgeting effectively brings communication from different stakeholders and larger healthcare systems, such as operational plans and planning targets for the benefit of staff and patients.

Strategic communication is simply ensuring the right information gets to the right place at the correct time, which is needed for budgets to become a reality by deadlines. The alignment of different departments is covered in the first point describing the benefits of budgeting and strategic communication in healthcare management:

- Operational plans become aligned with financial planning goals.

- Capital investments are prioritized by managers as they become aligned with strategic initiatives.

- Capital spending and cash flow are more accessible to manage more efficiently.

- Financial teams and healthcare managers understand budgeting better when specific projects and care departments are assigned funding.

- When managers plan budgets carefully, they reduce purchasing errors.

These benefits ensure that an accurate budgeting process is always part of any healthcare manager’s routine. When managers stick to practical budgeting and strategic communication principles, revenue, patient outcomes, and staff satisfaction can be improved.

Factors That Affect A Healthcare Management Budget

Unlike many other industries, healthcare management is complex and subject to last-minute changes and trends affecting several patients and the treatments needed. Covid-19 is one of the best examples of this, thoroughly shaking up what care is necessary, how healthcare organizations administer care, and even how people feel about receiving any care. Here are some factors which will affect your healthcare management budget:-

- Economic events beyond prediction, like the Covid-19 pandemic, quickly change the budgeting process from static to dynamic, needing constant updates.

- Younger people have reduced their use of standard insurance payment models, meaning hospitals get paid differently or later.

- Digital disruption, such as wearable technology and video-conferencing, means fewer inpatient stays.

- External agency staffing provisions cause shortages in staff and increased costs.

- A changing market for mergers and acquisitions leads to changes in how care is delivered.

- Issues in the supply chain are causing delays to the provision of personal protective equipment (PPE) or a wide range of drug shortages.

These factors create a need for a detailed and comprehensive budget. Managers cannot always predict these factors even with a budget, but the hospital’s finances will not be affected so dramatically, leading to greater resilience over time. Using best practices is another way healthcare organizations can protect themselves against modern challenges.

Healthcare Budgeting Best Practises

Best practices can help protect against unpredictable geopolitical challenges. The first of these best practices is creating a calendar, and the other practices revolve around ensuring that organization and planning are the priority of sustainable healthcare systems:

- A calendar is essential to budgeting: Who, How Much, and When are important details to include to ensure managers sign projects off in time.

- Deadlines must be realistic, or managers will miss them, causing delays and frustration.

- Remember that the budgeting process is ongoing, so use data from rolling forecasting to its best use, update budgets regularly, and learn from each update.

- Formulate a monthly process for analyzing variances in the market.

- Make reports simple for new users.

- Offer more experienced users more detailed insights.

- Keep automated planning systems updated.

Following these best practices protects against future threats and reinforces the strengths of the capital budgeting process and strategic communication. Following these best practices is not always easy, but hard work today leads to strong healthcare organization stability tomorrow, so it’s always worth the effort.

Why Are Budgets So Important?

Healthcare systems thrive on the altruism of staff to save patients’ lives. However, the healthcare manager is often a much less visibly heroic leader but has the equally important job of balancing the books to ensure that the funds exist for their hospital to provide the selfless staff. Despite the impression that healthcare systems are all about altruism and saving lives, someone must pay for the service.

This environment creates the initial need for budgeting. However, the other reasons are to provide data for metrics for success and ensure the best care is provided for business sustainability, and to avoid litigation. Managers could view budgeting as a drain on resources better spent dealing with the everyday challenges of a dynamic healthcare system. But without budgeting, there may be no hospital infrastructure at all. It’s essential to keep an eye on finance and treat budgets as an ongoing learning process that needs updating and pro-active adaptability practices to changing political and economic times. When managers achieve this, they support every nurse, doctor, healthcare assistant, administrator, and cleaner on the payroll to be part of a world-class healthcare organization.