In every industry, digital transformation looks different. For banking, the change has been nothing short of an evolution. It has gone from a paper-heavy, slow and digitally-resistant industry, to one that now holds fast and furious competitors to stay ahead in the race.

What are bank leaders today facing as they are now inevitable players in the technology game?

A three-layered approach to DX

It can be overwhelming to approach the many and multifaceted challenges of digital transformation. For the banking industry specifically, it’s important to remember that there are two distinct transformations that need to occur within the bank organization itself, and one that needs to be developed for external consideration.

These three layers are the workplace, the customer journey, and open banking.

The Digital Workplace of Banking

Bank CIOs and CDOs, take a deep breath. The challenges you are facing, trying to transform your internal organization into a smooth digital machine, are the same ones that everyone in all industries are facing.

This should be a huge relief because it means that you don’t have to reinvent the wheel. Not only are there software tools that will be the most customized for your industry, but you can also rest assured that just like any large enterprise, you can most definitely realize a digitally-enabled organization.

When approaching the workplace aspect of transformation, you want the focus of your technology investments to be your employees. The bank industry is known for having a serious and loyal workforce. Bombarding bank employees with software and simply throwing the traditional systems in the trash will not go over well.

Instead, utilize software to boost communication and make the employee experience better. Banks have so much data that they need to gather, store, and transport. Transitioning data-collection and communication into a digital system will take menial tasks, excessive paper-use, and tedious processes off of employees’ shoulders. In their place, you can provide digital tools to do the heavy lifting.

Similar to all industries, banks need to learn how to help their employees manage change specifically due to technological disruption. This is where a digital adoption solution can be imperative for ensuring that employees don’t feel left behind.

Remember that the human experience of digital transformation doesn’t just apply to your customers, but very importantly, to your employees. Employee performance can see huge improvements with the right tools and a realistic approach to digital adoption.

The Customer Journey of Banking

The customer has never been more entitled. The user experience dictates all. Consumers demand an easy, seamless, and fully customized experience. If grocery shopping can be done through an app, then their banking should be just as easy.

This is the mindset that bank leaders need to have in order to keep up with the competition. People expect banking to feel like every other service, and so banks need to deliver.

Four out of five financial institutions agree that digital transformation is fundamentally changing their industry, but according to the Boston Consulting Group, 43% of them haven’t developed a digital strategy. This means that bank executives feel that digitalization is an impending reality, but they don’t know how to get on top of it.

How can banks go from traditional to digital processes?

Reduce the paper trail

Assess your customer journeys and try to reduce the steps that require paper, an in-person visit, or a physical action on the customer’s end. From creating an online signature option to quick loans to money transferring, you want to find every possible way to simplify and digitize your customer experience.

Don’t be daunted by the enormity of the project. Start by evaluating what the most common customer journeys are, and how many steps are involved in them. Then, create a digital strategy to minimize the physical aspects and optimize the digital ones. Start small, but start somewhere.

Use your data

Use your data to customize the bank experience. Banks are able to amass details and information about their customers on a huge scale. It’s time to utilize that data to create a user-journey that feels more like Amazon and less like the bank. If a customer normally takes out a loan once a year, create an automatic notification to offer a loan when nine months post-loan is approaching.

Data analytics can provide extremely valuable insights to help you better understand your customers, and better serve them. These tactics don’t feel invasive to customers, rather they feel preemptive and personalized.

Open Banking

The game-changer for banks is the fact that they are no longer only competing with other banks, but with finance-related apps that make basic banking apps look dated and rigid.

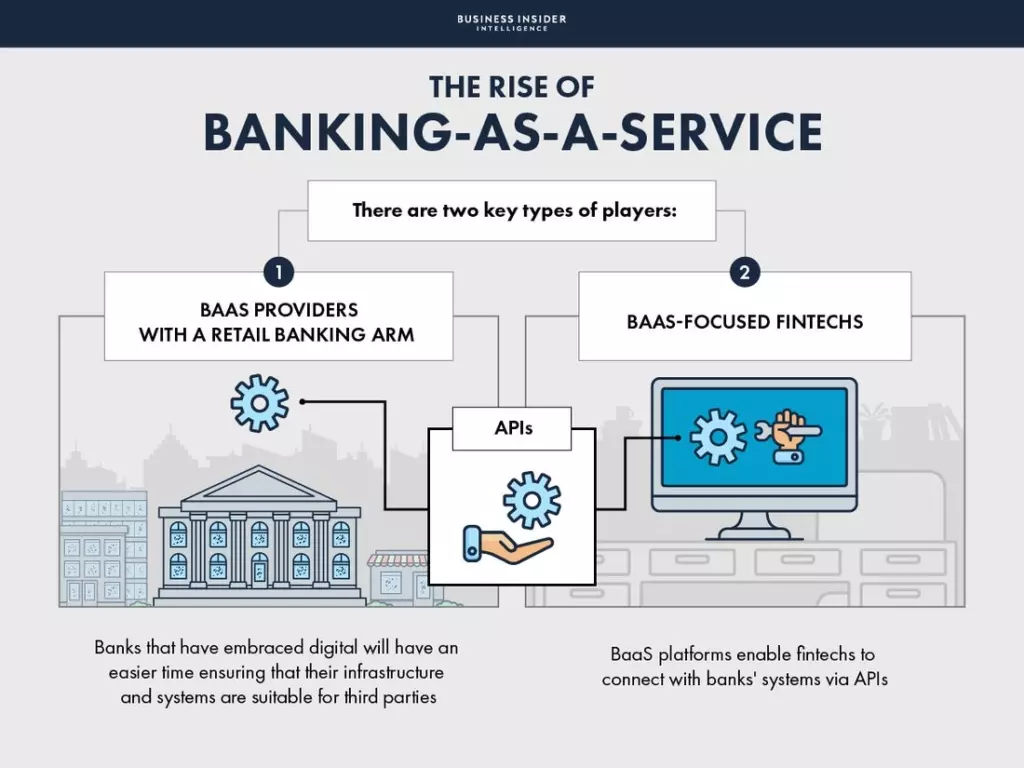

Open banking is the practice of financial information being shared through APIs securely and with customer consent, with third-parties. This is what BAAS (banking as a service) and some FinTech (financial technology) are referred to by high-tech.

This has opened the door for endless mobile and app services, all trying to get a piece of the banking pie. For banks, this means that they need to seriously up their game and offer the same options at the same level of ease.

If you’re still confused about open banking, think about the last time you needed to pay a friend back for something and didn’t have any cash on you. Instead of needing to go find an ATM, you probably said: “Do you have (insert your choice of payment app here)?” Chances are, your friend did have it. We all do now. Because it’s easier than signing into your bank, even onto your bank’s mobile app, and doing an instant bank transfer.

Credit: Business Insider

Consumers will always find the easiest and most enjoyable way of doing things. You can count on that. So if there’s an option that’s easier than yours, they will find it and use it.

Do not lay-low on this one. Assess the open banking capabilities and immediately implement a digital strategy that takes them into account. Other banks are no longer your only competition. Whether you like it or not, you are now competing with mobile apps.

Banks can conquer this

Despite the challenges ahead, bank leaders have an incredible opportunity to lead the charge of going digital. There is a plethora of data and therefore insights to leverage in this industry. The most digitally-enabled banks will not only be able to survive digital transformation but will be able to redefine their entire industry, setting new standards both for employees and customers.

With a determined and educated mindset, a digital workplace culture, and a well-defined adoption strategy, banks are more than equipped to dominate digital.