As the insurance industry continues to evolve, companies are constantly looking for ways to improve their customer experience.

One of the most promising technologies in this regard is conversational AI. With the ability to process natural language and respond to customer inquiries in real time, conversational AI has the potential to revolutionize the way insurers interact with their customers.

But what exactly is conversational AI, and how can it be used in the insurance industry? In this ultimate guide to conversational AI for insurance, we will explore the ins and outs of this exciting technology.

We will discuss the basics of conversational AI, including how it works and what makes it different from traditional chatbots. From there, we will dive into the specific ways conversational AI can be used in the digital insurance industry, such as answering common customer questions, providing personalized policy recommendations, and even processing claims.

Implementing conversational AI has its challenges. We will address some key considerations that insurers need to consider when developing a conversational AI strategy, such as ensuring data privacy and accuracy, managing customer expectations, and integrating with existing systems.

Throughout this guide, we will draw on real-world examples of conversational AI in action, highlighting this technology’s benefits and limitations in the insurance context. We will also provide practical tips for insurers looking to incorporate conversational AI into their customer service and operations.

Whether you are new to conversational AI or want to deepen your understanding of how this technology can be used in the insurance industry, this guide is for you. So let’s dive in and explore the world of conversational AI for insurance.

What is conversational AI?

Conversational AI refers to the technology that enables machines to understand and respond to human speech or text, mimicking natural human conversation. It uses hyperautomation processes such as natural language processing (NLP) and machine learning (ML) techniques to interact with humans in a personalized, efficient, and human-like manner.

What makes conversational AI different from traditional Chatbots?

Chatbots use pre-programmed scripts to respond to customer queries, while conversational AI uses artificial intelligence (AI) and machine learning algorithms to understand customer requests and provide personalized responses.

This means that conversational AI can respond to questions more naturally, as it is not limited by pre-programmed scripts.

Conversational AI & insurance: What’s the connection

Conversational AI is transforming the insurance industry by providing personalized customer experiences, streamlining claims processes, and enhancing customer engagement.

Some of the top use cases of Conversational AI in the insurance industry include:

- Automated claims handling

- Customer query resolution

- Policy recommendations

- 24/7 assistance

Conversational AI and the insurance industry are intricately connected due to the various applications of conversational AI that can enhance customer experience and streamline operations in the industry.

Insurance companies are increasingly adopting conversational AI-powered virtual agents and chatbots to provide customers with human-like experiences when they contact customer service. These virtual agents can handle routine queries, offer policy recommendations, and simplify the claims process, allowing customers to navigate the insurance landscape easily.

Conversational AI can also analyze customer data and identify patterns and trends to help insurance companies improve their products and services. Through machine learning algorithms, conversational AI can predict customer behavior, preferences, and needs, enabling insurance companies to offer proactive solutions to customers.

According to the same report from Gartner, adopting conversational AI will decrease labor costs for contact center agents by 2026, resulting in a total saving of $80 billion. This highlights the growing importance of conversational AI for the insurance industry to remain competitive and meet customers’ changing needs.

Conversational AI and the insurance industry are connected through the enhanced customer experience, streamlined operations, and improved data analysis that conversational AI provides.

It is evident that conversational AI has become a valuable tool for the insurance industry, enabling them to stay ahead of the curve and meet the demands of an ever-changing market.

Conversational AI for insurance: Benefits & use cases

Conversational AI is transforming the insurance industry in many ways, providing befits for customers and insurers.

Let’s take a closer look:

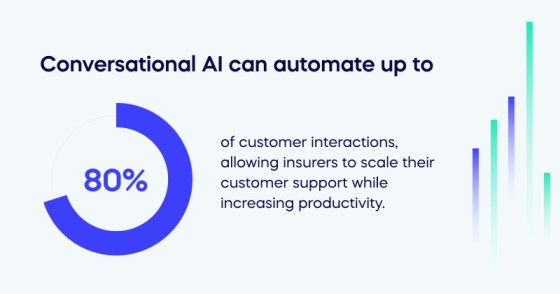

Scaling customer support

Conversational AI can automate up to 80% of customer interactions, allowing insurers to scale their customer support while increasing productivity. Chatbots can handle a wide range of customer inquiries, from basic questions about policies to complex claims processing.

Conversational AI can reduce wait times and improve customer satisfaction by freeing customer service reps to handle more complex inquiries.

Improved customer experience

Conversational AI solutions can enhance customer satisfaction by automating conversations and providing personalized policy recommendations. Chatbots can be programmed to answer common questions about policies, premiums, and claims.

Conversational AI can also give customers customized recommendations based on their past behavior, needs, and preferences. This can enhance the customer experience and help insurers strengthen their customer relationships.

Cost reduction

With conversational AI, insurance companies can reduce costs associated with hiring and training customer service representatives. Chatbots can work around the clock, handling customer inquiries even when reps are unavailable.

This means that insurers can provide 24/7 customer support without hiring additional staff. Moreover, chatbots can learn and improve over time, reducing the need for ongoing training and support.

Fraud detection

Conversational AI can flag new policies and identify potential fraud, helping insurers to mitigate risks. Chatbots can analyze customer interactions for patterns indicating fraudulent activity, such as unusual claims or suspicious account changes.

Insurers can protect their business and prevent losses by detecting and flagging potential fraud in advance.

Data collection

Conversational AI chatbots can collect contact data from customers, providing insurers with valuable insights that can be used to improve their products and services. Chatbots can track customer behavior, preferences, and feedback, providing insights into what customers want and how they interact with the company.

This data can be used to refine marketing strategies, improve product offerings, and enhance customer satisfaction.

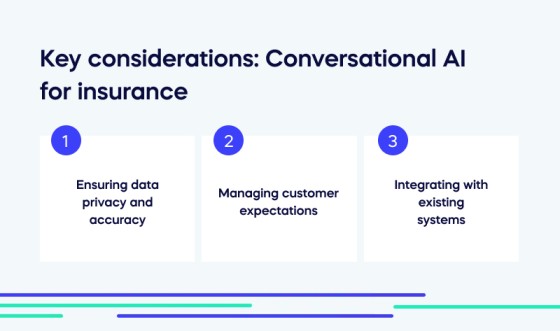

Key considerations: Conversational AI for insurance

Insurers must consider the following points when employing conversational AI for their insurance operations:

Ensuring data privacy and accuracy

Insurers must guarantee that customer data is handled securely and that chatbots are programmed with accurate information. It’s important to have protocols to protect customer data and ensure that chatbots provide correct information.

Managing customer expectations

Insurers must manage customer expectations when deploying chatbots, ensuring that customers understand the limitations of conversational AI. Chatbots can be used to answer basic questions and provide policy recommendations, but they cannot replace human customer service representatives.

Integrating with existing systems

Insurers must ensure that chatbots are connected to current systems and can use customer information. This will enable them to provide personalized recommendations and improve customer satisfaction.

Examples of how conversational AI is being used in the insurance industry

We’ve found some practical examples of how businesses in the insurance industry are using conversational AI.

These will give you an idea of the possibilities that conversational AI can bring to your business and help you explore the ways in which you can use AI to enhance the customer experience and streamline operations in your insurance company.

Lemonade Insurance

Lemonade is an insurtech company that leverages Conversational AI to provide customer service through its app and website.

Its AI-powered chatbot, Maya, uses Natural Language Processing (NLP) to understand customer queries and provide personalized responses. Maya can assist customers with various tasks such as filing claims, updating policies, and answering coverage, pricing, and policy details questions.

Besides NLP, Lemonade’s Conversational AI system also uses Machine Learning algorithms that enable it to learn from past interactions and provide more accurate and relevant responses over time.

Allstate Insurance

Allstate is a large insurance company that uses AI-powered virtual assistants to handle customer queries. Its virtual assistant, ABIe, uses a combination of Machine Learning, NLP, and

Speech Recognition to interpret customer queries and provide relevant responses.

ABIe can help customers with policy changes, billing inquiries, and claims processing. It can also escalate complex queries to human agents if necessary.

MetLife

MetLife is a multinational insurance company that uses Conversational AI to provide customer service through various channels, including its mobile app, website, and social media platforms.

Its chatbot, Sal, uses NLP and Machine Learning to understand customer queries and provide personalized responses. Sal can assist customers with policy information, billing inquiries, and claims processing.

As customers interact with the chatbot, Sal learns from their behavior and preferences, enabling it to provide more personalized and relevant recommendations.

Liberty Mutual

Liberty Mutual is an insurance company that uses AI-powered chatbots to handle customer inquiries. Its chatbot, Emma, uses NLP and Machine Learning to interpret customer queries and provide relevant responses. Emma can help customers with claims processing, policy management, and general inquiries.

Besides handling customer queries, Liberty Mutual’s Conversational AI system also monitors customer sentiment and feedback, enabling the company to continuously improve its services.

USAA

USAA is an insurance company that primarily serves military members and their families. It uses AI-powered chatbots to provide customer service and claims assistance. Its chatbot, EVA, uses a combination of NLP and Machine Learning to understand customer queries and provide personalized responses.

EVA can help customers with policy information, claim status updates, and other tasks. USAA’s Conversational AI system also uses sentiment analysis to monitor customer feedback and improve its services over time.

Tips for insurers implementing conversational AI

Incorporating conversational AI into customer service and operations is becoming increasingly important for insurers as the industry becomes more digital.

AI can help insurers provide better customer experiences, reduce costs, and improve operational efficiencies. However, insurers must approach the implementation of AI strategically to achieve these benefits.

Here are some practical tips for insurers looking to incorporate conversational AI into their customer service and operations:

- Start with a clear goal in mind: Before implementing conversational AI, insurers should define their plans for using the technology. This could include improving customer satisfaction, reducing costs, or increasing efficiency. A clear goal will help insurers choose the right AI solution and measure its success.

- Choose the right AI solution: Many different AI solutions are available, each with its own strengths and weaknesses. Insurers should choose a solution appropriate for their specific needs, whether a chatbot, voice-activated assistant or other type of AI.

- Train your AI solution properly: To ensure that your AI solution provides accurate and helpful responses, it needs to be trained properly. This involves feeding it with data, testing it, and refining it over time. Insurers should monitor their AI solution regularly to ensure it functions as expected.

- Integrate AI into existing systems: AI should not exist in a vacuum. It must be integrated into existing systems and processes, including customer service and back-end operations. This will help ensure that the benefits of AI are fully realized.

- Continuously improve and optimize: AI is not a one-and-done solution. It needs to be constantly improved and optimized over time. This involves monitoring its performance and making adjustments as needed. Insurers should also stay up-to-date with the latest developments in AI technology and best practices.

Users can use the practical tips provided in this article to integrate conversational AI into their customer service and operations, resulting in improved customer experiences and increased operational efficiencies throughout the company.

Conversational AI: A game changer for the insurance industry?

Conversational AI has emerged as a revolutionary tool for the insurance industry in recent years, providing unparalleled customer experiences with improved operational efficiency.

The proliferation of chatbots, virtual assistants, and voice assistants enables insurance providers to offer more personalized and interactive services to their customers while reducing costs.

Implementing Conversational AI technologies allows insurance companies to streamline their processes, resulting in increased efficiency, better service delivery, and cost-effective operations.

Furthermore, the data collected through these interactions help insurers gain valuable insights into their customers’ needs, preferences, and behaviors. This data can be harnessed to tailor the products and services provided by insurance companies to better meet customer needs.

In today’s world, customers expect prompt responses and round-the-clock service, and Conversational AI offers unprecedented capabilities to meet such demands. As technology evolves, it is expected that Conversational AI will continue to play a significant role in the insurance industry, offering new solutions and advancements that will benefit insurers and customers.