The coronavirus continues to rage on across the world, with new hotspots continuously popping up that require new safety measures to keep the virus at bay. In this unpredictable environment, companies must show unprecedented flexibility to ensure business continuity. This requires two main things to happen: digital tools for employees to be able to work from home in a compliant and efficient way, and for remote customers to onboard and buy new products.

For businesses that were prior to the coronavirus accustomed to working and selling face-to-face, the sudden transition to remote work was disruptive. The vast majority of companies managed to scramble to piece together stopgap measures. But with the coronavirus showing no sign of ending in the coming weeks or even months, more robust and reliable measures are needed to ensure the continued feasibility of this remote reality.

In this blog post, we’ll discuss how the coronavirus has changed consumer and employee habits, and offer five key digital tools that will transform the way businesses operate — both during the coronavirus and after it passes.

New remote consumer habits

Previously mundane interactions have now become fraught with danger since the coronavirus pandemic began. As a result, consumers are minimizing their amount of time they spend shopping, going to banks, and other errands that used to be done without thinking twice. In a recent Lightico survey, 82% of respondents expressed fear surrounding going to their local bank or grocery store. Strikingly, 49% said they would avoid taking a loan from a bank if it would require going to a physical branch. This shows that many many consumers are willing to postpone even critical services if it means possibly risking virus transmission.

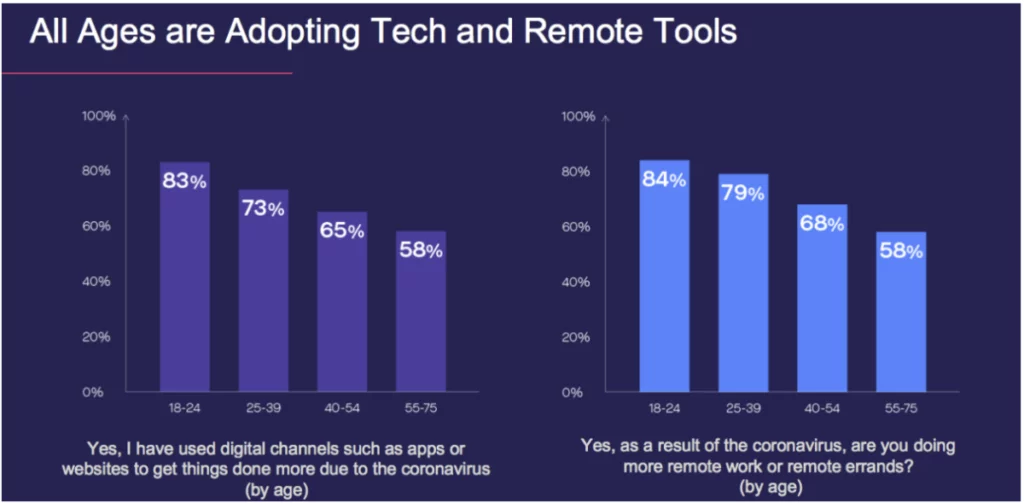

On the flip side, customers are exhibiting high levels of openness to using new technology to work remotely or run errands. The vast majority of younger people aged 18 to 24 are adopting more remote tools in light of the coronavirus, at a rate of 83%. But even the oldest group in the survey, Americans aged 55-75, are turning to remote ways of working and consuming at a rate of 58%. In fact, there isn’t a single age group that isn’t exhibiting higher levels of interest in remote tools.

Many companies today offer at least partially digital solutions — but the problem is that they aren’t complete. For example, before the coronavirus outbreak, 65% of consumers who attempted to complete a financial transaction online were redirected to a physical branch. During usual times, this is a source of frustration and hurts the customer experience. During the coronavirus, it’s a liability and a business blocker.

New remote working habits

According to a Clutch survey, 66% of US employees are working remotely due to the coronavirus. While most report being just as or more productive when working remotely, there is one group that faces unique challenges: frontline employees, many of whom are also call center agents. For this important group of employees, working remotely isn’t as simple as jumping on a Zoom call or pinging coworkers on Slack. They are accustomed to working with specially designated software that’s installed on their computers, such as CRMs and agent dashboards. They must also contend with issues such as PCI compliance, which can be challenged in a work-from-home environment.

Intuitive solutions to aid remote frontline employees and customers

Companies looking to facilitate easy, intuitive, and compliant remote transactions between employees and customers should look for all-in-one platforms that support the majority of their activities. One-off measures, such as adding a chatbot or enabling digital signatures, is unlikely to create the smooth and consistent experience employees and customers are looking for as they interact remotely.

With agents working from home and customers buying from home, companies should be operating under the premise that nobody has access to the litany of channels they used to, such as a printer, computer, scanner, and fax machine. And with these remote solutions, they don’t need to.

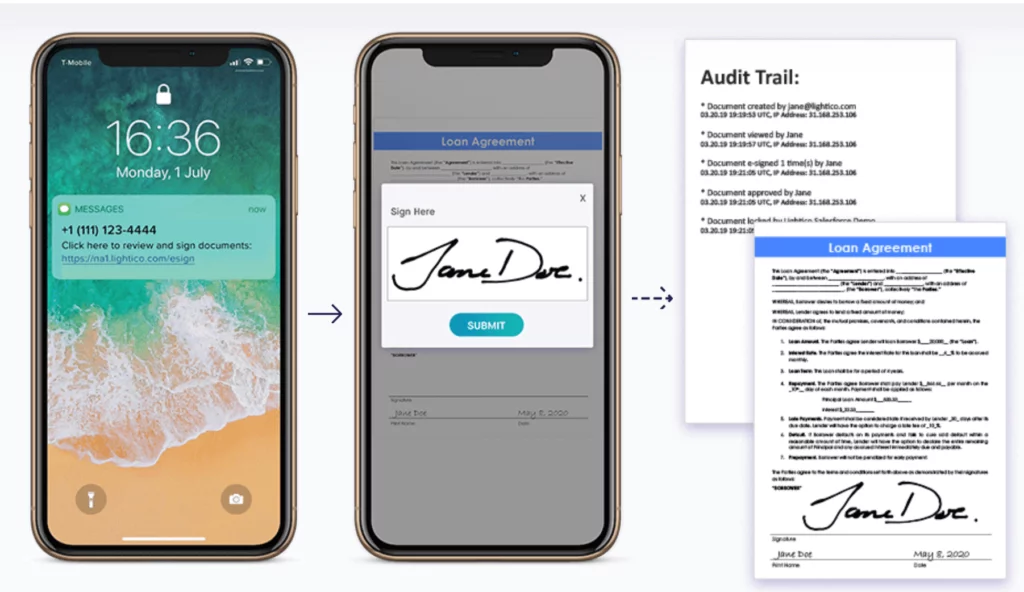

Capability 1: eSignatures

Get eSignatures completed remotely, quickly

Allow homebound customers to sign contracts, forms, and agreements from their cell phones or another digital channel of choice. Unlike wet signatures, eSignature solutions do not require going to a physical branch or dealing with snail mail. The most advanced eSignatures don’t even require checking email inboxes or even downloading annoying phone apps.

eSignatures can be deployed from any customer touchpoint including website, chat, or IVR. They can even be used during a call with a contact center agent who can guide customers through the signing process. In addition to enabling safe remote interactions, eSignatures have also been proven to generate 50% more completed signatures than traditional methods.

Capability 2: Smart eForms

Get all forms completed remotely, easily, and error-free

Especially now that many businesses are reducing their workforce or splitting teams across different locations, agents cannot be burdened with chasing customers for forms or error-filled fields. User-friendly electronic forms provide customers with an intuitive interface so they can complete all the required information correctly the first time, eliminating rework and chasing.

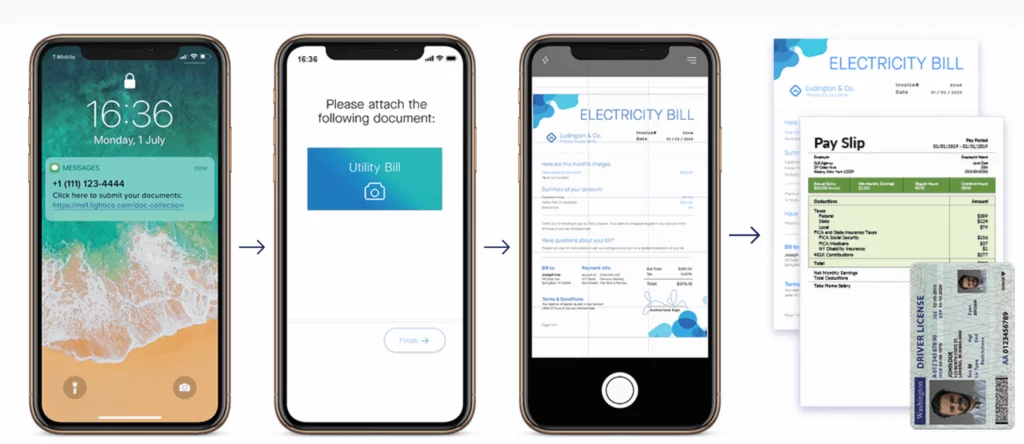

Capability 3: Simplified document collection

Instantly collect required documents from customers

Collecting documents such as a driver’s license, proof of income, invoices, and utility bills are often a requirement for customer onboarding and servicing in regulated industries. However, physical document collection processes are difficult or impossible to manage when both customers and frontline employees are remote.

Enabling customers to digitally uploading and send documents to agents requires no special equipment or leaving the house. It also accelerates compliance processes and speeds cycle time by 80%, minimizing the back and forth between agents and customers.

Capability 4: Secure payments

Collect PCI-Compliant payments instantly

Digital solutions make collecting payments instant, convenient, and fully PCI-compliant.

At a branch or office, agents typically have access to compliant software that protects customer credit card data. But the mayhem of the coronavirus has led to an increase in fraud attempts, while working from home often means start/stop software is unavailable or unused.

With secure digital transaction sessions, companies can provide remote customers with a convenient way to make payments directly from their digital channel of choice in real-time. This removes the need for clumsy web directs, DTMF, and stop/start recording which hurt the customer and agent experience.

Capability 5: Digital storage & security

Ensure secure storage of all customer interactions

Secure digital document storage can simplify adherence to compliance, security, and quality guidelines. By capturing all customer interactions digitally, it is easier to audit and track customer interactions. All documents are digitally stored and stamped with seals to ensure safe and secure storage and quality control. Thanks to digitized contracts, supporting documents, and consent forms, businesses can simplify audit and quality checks of their customer interactions.

Digital capabilities enable remote business operations

As lockdowns are prolonged or reinstated, and customers continue to be fearful of venturing outside, businesses need to adopt quick but effective solutions to ensure business continuity.

Even as sales taper off due to the economic crisis, customer-facing remote solutions allow companies to make the most out of existing opportunities, all while keeping communities safe.

Once we return to healthier times, it is very likely that those companies that enabled digital and frictionless processes early in the crisis will be the ones to not just survive, but thrive into the future.