Have you ever considered why financial organizations must constantly transform more than other companies?

Financial organizations are one of the most vulnerable to digital disruption due to the changeable nature of the economy.

Often, the technologies used in finance later become adopted in other industries, making finance the epicenter of technological progress for some technologies like blockchain and ERP solutions. This environment makes finance transformation essential in 2023.

To help you understand precisely how to find your place as one of the most valued agile leaders in your organization, we will explore the following topics:

- What is finance transformation?

- Why do we need finance transformation in 2023?

- How does finance transformation benefit your financial organization?

- What are the best practices for finance transformation?

- What technologies will drive finance transformation in 2023?

What is finance transformation?

Finance transformation is a process that involves making changes to the financial model so that it is more suitable for the digital age and can operate more independently.

Financial organizations need to invest in finance transformation initiatives to remain competitive.

Why do we need finance transformation in 2023?

We need finance transformation in 2023 because modern organizations require a finance function that empowers strategic goals, emphasizing digitalization. The changeable nature of the economy also impacts this scenario due to events like the Covid-19 pandemic, the Ukraine-Russia conflict, and the resulting economic downturn.

CFOs must expedite transforming their finance operations into autonomous finance to avoid falling behind by making finance transformation part of their company’s DNA, incorporating financial planning into existing processes and systems, not just in the finance department but company-wide.

Organizations in 2023 require more precise and prompt data to enhance decision-making concerning various aspects such as pricing, products, and investor and customer engagement. This context highlights the need for a successful finance transformation journey.

Key drivers for finance transformation in 2023

Ten key drivers inform the organization’s decisions to invest in finance transformation in 2023.

1. A requirement for more efficient processes.

2. Optimized financial controls.

3. Improved reports and stakeholders.

4. Satisfying changing customer demands.

5. Need to digitalize finance processes for digital resilience.

6. Increasing complexity of business architecture.

7. Requirement for shorter cash cycles.

8. Pressures of globalization.

9. Market uncertainty.

10. Supplier integration needs.

Consider these drivers when planning your finance transformation to ensure success.

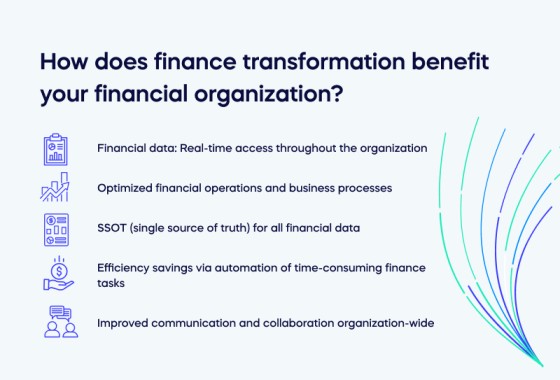

How does finance transformation benefit your financial organization?

Finance transformation is a game-changing process that can help companies take their financial management practices to the next level.

But what are the benefits of finance transformation, and how do they affect your financial functioning? Here are a few of the many benefits:

1. Financial data: Real-time access throughout the organization

One of the benefits of finance transformation to your organization is that it allows real-time access to financial data throughout your organization.

Real-time data access allows the following benefits:

- Your finance team can quickly identify potential issues and opportunities with current, relevant data.

- Monitor your financial performance.

- Measure your progress against KPIs.

A thorough understanding of financial information can improve communication with stakeholders such as investors, customers, and business partners. This action, in turn, can facilitate trust-building and enhancement of an organization’s reputation.

2. Optimized financial operations and business processes

By implementing a more efficient workflow, finance teams can save time and resources, reduce manual errors, and provide a better experience for customers and suppliers.

One of the primary reasons is to remove blockages in the financial process and speed up the order-to-cash cycle.

3. SSOT (single source of truth) for all financial data

When companies consolidate financial data in one place, it prevents confusion and mistakes. Doing so ensures everyone can see and use the same data, eliminating the need to compare conflicting information or manually reconcile discrepancies.

As a result of having more accurate and reliable financial data, making decisions becomes more accessible and more efficient.

A single source of truth helps reduce security risks like data breaches, as companies store all financial information in one secure, centralized location.

4. Efficiency savings via automation of time-consuming finance tasks

Automating tasks such as invoice processing and account reconciliation can enhance accuracy and decrease the likelihood of errors for finance teams.

By automating financial processes, teams can save time to work on activities that bring more excellent value, including strategic planning, financial analysis, and risk management.

5. Improved communication and collaboration organization-wide

Finance transformation projects aim to enhance collaboration and communication throughout the organization by facilitating improved access to financial data and simplifying financial procedures.

The organization can benefit from better teamwork to reach its strategic objectives and increase its competitive edge.

Challenges of finance transformation

There are many challenges to a successful finance information project; it is vital to understand each to overcome them.

Inconsistent data management practices

Although companies have vast amounts of customer and transaction data, they might find it challenging to utilize it effectively. Without proper data management, the many insights available to different teams can be overwhelming.

Many companies rely on manual processes, resulting in more time spent moving data through email, spreadsheets, and various systems than analyzing it.

The financial transformation process involves utilizing your data to minimize risk and maximize returns on investment. Although the expense of transformation can be a barrier for small businesses, it is becoming necessary for conducting business.

Challenging nature of investors and stakeholders

Undertaking economic transformation can be demanding in terms of time and money for investors.

Investors and stakeholders tend to be cautious about taking risks in more conventional and heavily regulated industries, and the initial expenses can pose a barrier to receiving their backing.

Getting traditional investors and stakeholders on board is essential, managing their expectations, forecasting the return on investment, and assessing the risks of not taking action. Dedicate enough effort and time to convince everyone involved.

Remember that this process will transform your company’s approach to business, enabling you to be proactive instead of reactive during uncertain times.

Poor short- and long-term goals alignment

The pressure to meet immediate goals can affect how your team handles transformation.

Executives are accountable for achieving short-term targets whose success is measured by meeting these goals. They may not view their responsibilities aligned with long-term objectives such as finance transformation.

Improvements to the core business typically result in positive outcomes within months, whereas economic transformation can take 5-10 years for companies to benefit from fully.

As a result, leaders must discover effective methods of motivating executives to work towards and achieve these long-term goals and find alternative ways to measure overall performance.

Changing compliance standards and regulations

Companies expanding and operating in different parts of the world may face challenges meeting compliance standards and regulations. Prioritizing short-term goals over long-term solutions is often not the best approach.

Managing compliance will become increasingly challenging without proper technology. Regulations like ASC 606 for the accounting of recurring and deferred revenues and the widespread use of recurring billing models highlight the need for improved technology.

According to a recent article, non-compliance costs an average of over $14 million and impacts five specific areas: fines, penalties, and fees; disruption to business operations; loss of revenue; decreased productivity; and damage to reputation.

An evolving workforce creates retention challenges

it is essential to have a proficient team with technical skills to guide and sustain the changes rather than relying on technology to achieve finance transformation.

However, a potential obstacle to this is that the upheaval and unpredictability of the transformation process can cause talented individuals to depart.

Leaders should not avoid making necessary changes for fear of losing their best employees. However, they should have a plan for recruiting and retaining the right people to implement these changes.

What are the best practices for finance transformation?

Follow these best practices to optimize your finance transformation for sustainable success.

Align finance strategy to business goals

When aligning your finance strategy with your business goals, ignore historical spending, industry benchmarks, and traditional frameworks.

Instead, focus on your unique corporate strategy and the right level of financial resources to help the business succeed.

With this approach in mind, saving money and creating an environment where innovation thrives is possible.

Focus on high-value services

Prioritize resources towards services, markets, and products that generate excellent business value and reduce or remove low-value financial services.

By taking a strategic approach to financial management, organizations can become more agile and respond quickly when external conditions change.

Doing so requires finance teams to take an active role in helping the business identify growth opportunities and decide how best to allocate resources for maximum impact.

Ultimately, by aligning their finance strategy with their corporate strategy, businesses can ensure that they spend every penny in a way that will help them move forward toward achieving their goals.

Manage customer expectations

Instead of trying to please everyone involved, establish clear customer expectations and require them to choose between their wants and needs.

It’s important to remember that financial management is about more than just numbers; it also involves customer needs and expectations.

By aligning finance strategy with corporate goals, prioritizing high-value services while reducing or removing low-value financial services, and managing customer expectations, organizations can ensure they are making informed decisions that will help them build long-term success.

With these principles in mind, businesses have a better chance of achieving their desired outcomes and staying ahead of the competition.

Accelerate and automate reporting and financial close

In the past, finance teams relied on manual completion of all tasks. However, automating specific business processes, such as line item categorizations, can enhance reporting and data accuracy.

Automation in the financial-close process allows finance and accounting teams additional time for analyzing performance and providing leadership with the most precise data.

Prioritize high-value activities

By adopting conventional data metrics for analytics, finance teams can obtain valuable insights to inform future business decisions. For example, they can identify growth opportunities that are not performing well in business areas.

Tracking traditional financial metrics such as vendor payments or the total number of invoices doesn’t necessarily provide business value. Organizations can then transfer these data points into meaningful insights that guide decision-making by transitioning to analytics-based solutions.

What technologies will drive finance transformation in 2023?

It’s essential not only to improve your existing technology investments with currently available technology but also to look to the future to see what solutions to add to your tech stack to remain competitive using digital innovation. The first of these technologies is automation and blockchain.

1. Automation and blockchain technology will become widespread

Cloud-based ERP, automation, and cognitive innovation will increase in the coming years, making processes simpler and people more productive.

Blockchain technology will further speed up this trend as companies incorporate it into their finance transformation strategy. As a result of this change, human staff will have more opportunities to add value to their work that machines can’t replicate, increasing their well-being and maintaining higher employee retention.

Although some speculate about digital disruption causing finance to disappear, we do not believe that will happen. However, finance may become more efficient with fewer employees in operational roles such as order-to-cash and transactional accounting.

2. Real-time finance cycles will become the new standard

Organizations can then generate financial reporting like actuals and forecasts can whenever needed, meaning that the importance of traditional processes decreases. Doing so also means that the conventional separation of operational and analytical data becomes less relevant with improved access to accurate data.

Finance organizations will continue to provide cyclical information to meet external demands. Additionally, external investors may require more frequent updates on the organization’s performance.

Successful organizations will adopt a new approach where there is no specific time for forecasting, and real-time updates are the norm.

3. Operating models will transform

Companies will compare the advantages of automation for their onshore and offshore operations in the following ways:

- Finance organizations can reconsider their structure, work location, and finance functions they complete without human involvement.

- Finance-as-a-service will become more popular among companies beyond the mid-market.

- The offshoring and outsourcing space may experience considerable disruption, causing changes to the capabilities of individual suppliers.

- Finance organizations not preparing for the future will face challenges in building dynamic and cross-functional teams.

Make the DAP the core of your finance transformation efforts

Finance transformation is an essential tool for maximizing the potential of any business. With the right resources, strategies like DAP (digital adoption platform) can provide a powerful platform to drive success and align goals with action as part of your finance transformation roadmap.

The key is to understand what’s required and know the risks involved. By ensuring teams have access to the resources needed for effective transformation and creating commitment from all stakeholders, organizations can provide their financial performance will improve over time.

Ultimately, making the DAP the core of your finance transformation efforts is essential to reach simply stated objectives more quickly and maximize returns in a competitive market environment.