Businesses today are changing fast, making business transformation essential. Banks are no different. They often get slowed down by tasks like summarizing reports or drafting pitch books.

This is where generative AI can help. It can improve credit checks, make customer service better with smart chatbots, and strengthen security with real-time fraud detection.

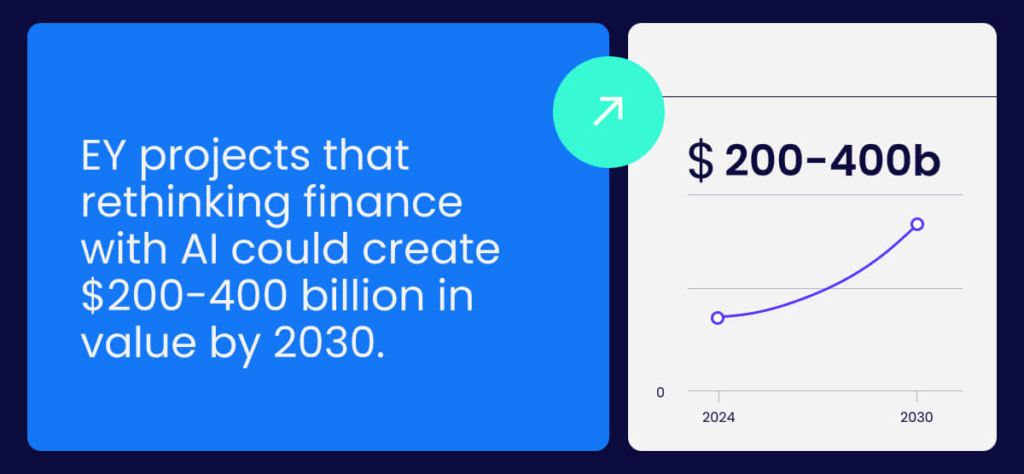

AI frees teams to focus on more strategic goals. EY projects that rethinking finance with AI could create $200-400 billion in value by 2030.

This article will explore generative AI in banking, including use cases, real examples, tips for implementation, and future trends.

What is generative AI in banking?

Generative AI in banking is the process of adopting technology to automate tasks, improve customer service, detect fraud, and increase efficiency and security in the banking industry.

AI systems like large language models (LLMs) and machine learning (ML) algorithms can perform tasks like automatically generating financial reports. They can also help analyze large data sets to spot fraud and handle routine tasks like processing documents.

How is generative AI used in banking?

Generative AI offers measurable benefits like cost savings, risk reduction, and revenue growth.

Here are some of its most useful applications:

Fraud detection and prevention

Generative AI helps banks find fraud and assess risks better. AI can quickly spot strange transactions and flag them as possible fraud.

AI can also create fake fraud scenarios to train models better, making them more accurate. Next, AI can find patterns in fraud alerts, which helps with decision-making.

Enhanced credit risk assessment and scoring

Banks can use generative AI to manage credit risk. This helps prevent financial problems and keeps things running smoothly. AI can spot potential risks early, giving banks time to react.

AI can also help with credit scores. Instead of just using traditional factors, banks can use AI to analyze lots of data from many sources. This gives a better picture of loan applicants.

Personalized customer engagement and targeted marketing

Use AI to analyze customer data, like their spending habits and what they look at online. Then, use this to create personalized offers and products.

AI can create messages, content, and products that each customer will like, which will make them more likely to buy and stay with the bank.

In this way, AI-powered personalization makes customers happier, leads to more sales, and improves marketing ROI.

Automated loan processing and approval

Your business can use generative AI to make loan processing faster and more accurate. AI can create fake data to make loan models better, check documents automatically, and assess risks. This speeds up the process, saves money, and makes it easier for borrowers.

Financial forecasting and market analysis

Your company can use generative AI to analyze a wide range of financial data, market trends, and client profiles. With this data, AI creates predictive models to recommend the best investment strategies.

These models can adjust portfolios as market conditions change. This approach helps banks maximize returns while managing risk.

Banks can offer clients more personalized investment strategies, improving customer loyalty. AI-driven investment management also reduces operational costs and makes scaling services easier.

Virtual customer assistants

Generative AI is making chatbots smarter. These chatbots can talk to customers like a real person. They understand what you say and give personalized help. They can also help you 24/7, making customers happier and businesses more efficient.

They can handle simple questions, allowing people to focus on harder problems. Chatbots work on many different platforms, such as apps, websites, and messaging services, making them easy for customers to use.

Real-world examples of generative AI success in banking

Below are some real-world case studies of leading banks successfully leveraging generative AI:

Wells Fargo

Wells Fargo’s AI app gives customers personalized advice. They can tap a blue lightbulb to see over 50 tips based on past and future spending.

The bank also uses AI in other areas like marketing, customer service and credit decisions. This helps bankers understand what customers may be interested in.

For instance, its AI virtual assistant, Fargo, had nearly 15 million users and over 117 million interactions in its first year.

Morgan Stanley

Morgan Stanley introduced a generative AI assistant called Debrief to help advisors. It keeps detailed logs of meetings. It also creates draft emails and summaries automatically.

Built using OpenAI’s GPT-4, Debrief joins client Zoom meetings. It replaces the need for advisors or junior staff to take notes by hand. In July 2024, Morgan Stanley rolled it out to about 15,000 advisors.

BNP Paribas

BNP Paribas has over 750 use cases in production and plans to grow further. A recent partnership with Mistral AI shows this. Through this partnership, it will implement large language models (LLMs) across various areas, like customer support.

The bank is also developing its own chatbots for both internal and external use. BNP Paribas uses AI to better understand customers, improve their experience, increase operational efficiency, and strengthen risk management, especially in cybersecurity.

Citigroup

Citigroup’s risk and compliance team used generative AI to analyze the impact of 1,089 new capital rules from federal regulators. This AI-powered analysis helped the team quickly understand the rules and make informed decisions.

Since then, Citigroup found more than 350 ways to use AI. They use it to analyze documents, create content, and understand global rules. This speeds things up and lets staff focus on clients.

How can you implement generative AI in banking

Below are the steps you need to ensure the successful implementation of generative AI in banking:

Define strategic priorities and align with business objectives

Banks need to know why they want to use generative AI and how it will help the business. They should find areas like customer service or fraud detection where AI can make the biggest difference. They should also set clear goals for what they want the AI to do.

Next, banks need to check their data to ensure it’s good, secure, and reliable. They need enough storage and accurate data to train AI. If the data has any problems, they need to fix them before using AI.

Invest in robust and scalable data infrastructure

To build a strong and scalable data system for generative AI in banking, focus on creating a cloud-native platform with high-performance computing. Make sure it includes data security and governance features.

Use flexible storage options and set up data pipelines to process large amounts of customer data while meeting regulatory standards. This will help train and deploy AI models for various banking uses.

Pilot generative AI applications for testing and refinement

Generative AI allows for quick development cycles. Pilots should test and refine quickly to make timely improvements. This keeps the project flexible and responsive. Successful pilots should focus on how the technology supports business goals, not just technical success.

Organizations should prioritize use cases based on their business value. Consider how each use case aligns with strategic business priorities. A pilot helps understand both the capabilities and limits of AI. Use insights to refine and scale successful use cases and discard those that aren’t viable.

Establish strong governance and risk management frameworks

To use generative AI safely, banks need clear rules for data, security, and checking. These rules should be easy for the AI to follow. Banks must find AI risks, like bias and security problems, and make plans to fix them.

They should also test the AI often and make sure it follows the rules. Banks should have a team to watch over AI use, and employees need to know about the rules and ethics of AI.

Future outlook for generative AI in banking

Here’s how generative AI is poised to shape banking’s future:

AI-first banking models and autonomous operations

In the future, banks will use generative AI in every area, from risk assessment to customer service. This complete integration will allow for faster, more personalized, and more secure customer experiences worldwide. Generative AI enables banks to run fully autonomous, customer-centric operations.

Generative AI assistants can help banks provide personalized interactions on a large scale, especially in customer service. AI-powered search also improves the self-service experience. Unlike simple keyword search, generative AI can find insights across articles that match the customer’s question. With a strong AI knowledge base, banks can reduce call volume by encouraging more self-service solutions.

Real-time insights for predictive banking

Generative AI can find hidden patterns in big data. This helps banks create tools to predict the future, enabling them to make better decisions for their customers.

For example, AI can create clear summaries to help with banking decisions, which makes things more transparent for both banks and customers.

AI can also predict what might happen in different situations, helping banks plan better. It can even use past data to make smart decisions about the future. AI can also create synthetic data to help with deeper analysis.

Reinvention of the current ways of working

Generative AI won’t change the core purpose of banking, but it will reshape how banks operate. Adapting to an AI-first world is essential. Banks that leverage AI effectively will gain advantages in agility, customer satisfaction, and profits. Accenture research shows that 73% of tasks in U.S. banks could be impacted by AI—39% through automation and 34% through augmentation. This shift will affect every role, from executives to frontline workers.

Generative AI can improve banking by handling routine tasks, allowing staff more time to focus on customers. But banks need a culture that is open to change. Otherwise, they risk falling behind. AI may also reshape talent needs, pushing banks toward skills-based management and flexible roles.

The road ahead: transforming banking with generative AI

Generative AI is changing banking and finance. It does things like automating tasks, making customers happier, and giving helpful advice for making decisions.

Some key ways it can be used are detecting fraud, giving personalized services, and assessing risks.

There are some challenges, like protecting privacy and security and ensuring accuracy. But its benefits are much bigger than these problems.

By using generative AI, banks can find new ways to grow. They can be innovative and offer more services that focus on customers to prepare their businesses for the future.

FAQs

Generative AI creates new content, such as text, images, and code. In banking, it helps automate tasks, improve customer service, and boost security.

Banking uses a type of AI called limited memory. This means the AI can store past data and use it to make better predictions. There are four types of AI: reactive machines, limited memory, theory of mind, and self-aware.