Every industry today is looking to take a bite of the automation apple with all its juicy benefits.

And the insurance industry is ideal for optimizing its processes through this technology due to its focus on moving money and managing thousands of clients’ sensitive data.

A recent survey revealed that in 2022, the banking, finance, and insurance industry spent $2.4 billion on robotic process automation (RPA) software solutions, making them one of the largest adopters of automated technologies.

Therefore, it is essential to invest in insurance automation to compete in today’s crowded marketplace.

To help you understand the importance of insurance automation and how you can use it to streamline processes and save resources, we will explore the following topics:

- What is insurance automation?

- Why are insurance companies using automation?

- What are the benefits of insurance automation?

- What are the best technologies for insurance automation?

- What are the limitations of insurance automation?

What is insurance automation?

Insurance automation simplifies insurance procedures such as sales, marketing, and renewals to improve insurance management efficiency using automation processes.

Maintaining a competitive edge using automation in 2023 is essential for your insurance company, as most industries are adopting automation like ChatGPT and natural language processing tools to make processes more efficient.

Why are insurance companies using automation?

Insurance companies have been using automation for a long time to improve their business processes and free up time for staff to focus on tasks machines cannot complete.

This information can help insurance providers better serve their clients, improving customer experience. Insurance companies can increase customer satisfaction and retention by using customer information to create customized products and services.

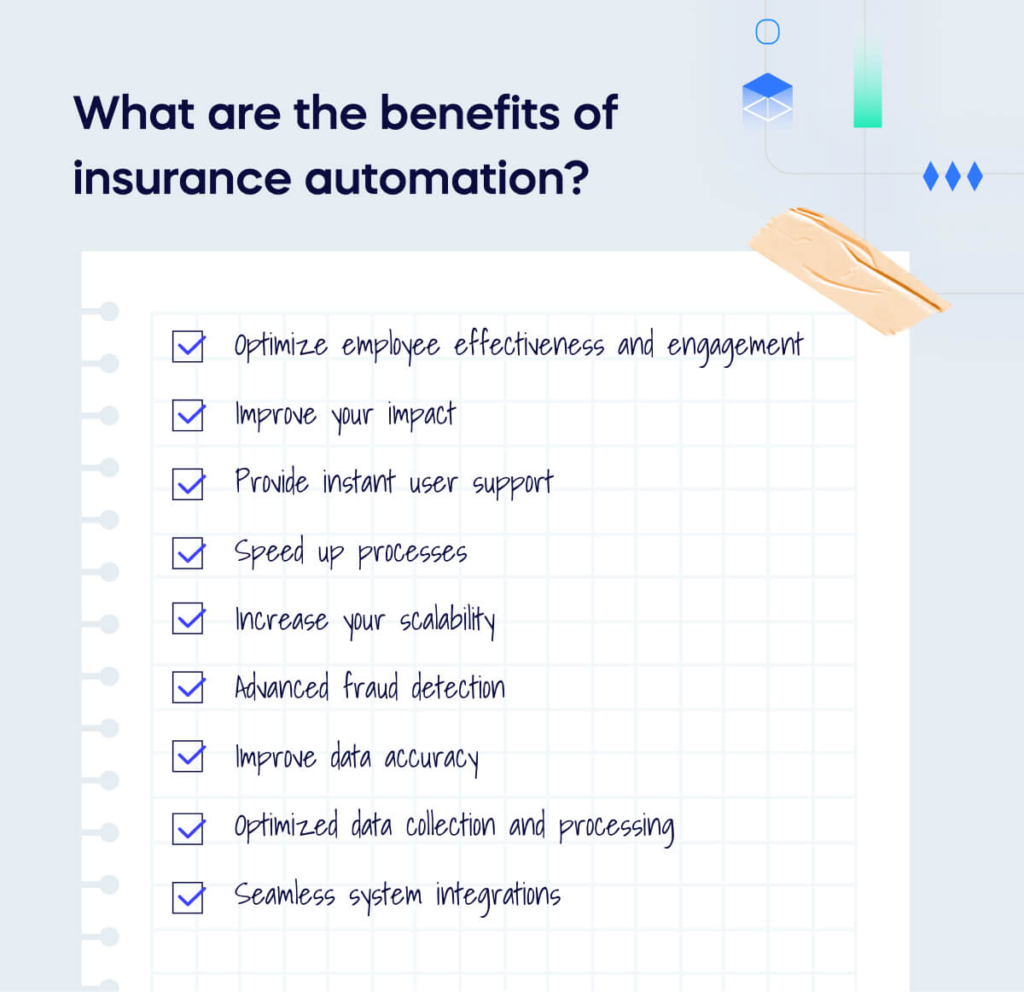

What are the benefits of insurance automation?

Automating crucial but time-consuming tasks can enhance operational efficiency throughout the organization. Adopting insurance automation can also let team leaders assist employees with more valuable lessons, reducing operating costs and improving employee engagement.

Optimize employee effectiveness and engagement

Insurance automation technology, like conversational AI, optimizes employee experience and effectiveness. With virtual assistants readily available to provide targeted recommendations and answer inquiries, live agents can perform their jobs confidently.

Improve your impact

Insurance companies can improve their impact by eliminating routine tasks and encouraging employees to engage in work that involves critical and creative thinking. Doing so can help keep employees engaged, interested, and motivated to do their best.

Provide instant user support

Insurance automation provides users instant support through virtual agents powered by generative AI and robotic process automation (RPA), the most commonly used tool in insurance automation.

Combined, these tools can handle most inquiries and escalate issues to live agents when necessary, improving customer experiences and eliminating long wait times.

Speed up processes

Insurance automation speeds up slow processes like claims processing and policy management, reducing customer wait times. This greater efficiency can improve the customer experience, possibly leading to increased satisfaction and long-term loyalty.

Increase your scalability

Intelligent automation allows insurers to expand their services without significantly increasing their staff by optimizing their front-end and back-end operations. This action creates an opportunity for cost savings.

Advanced fraud detection

Insurance fraud is a significant issue, with a cost estimated to be over $40 billion per year by the Federal Bureau of Investigation. However, insurers can address this problem by leveraging conversational AI, RPA, and other intelligent automation technologies.

Virtual agents can learn conversational patterns and identify social engineering attacks with training. When a potential attack is detected, the virtual agent can send an automated alert to the insurance company’s cybersecurity team using RPA, who can then take appropriate action.

Improve data accuracy

Automating insurance processes is beneficial as it saves time and enhances data accuracy. When individuals manually enter customer data, they are prone to making mistakes, leading to poor data quality.

Poor data quality can cause numerous problems, such as delaying claims, slowing down customer payments, preventing insurers from accurately pricing policies, and making data-driven decisions.

By automating the data collection process, intelligent automation removes the possibility of human error.

Optimized data collection and processing

Insurers can automate the processing of raw, unorganized data to prepare it for analysis besides automating data collection. Doing so saves time, diminishes the chance of human error, and enhances data quality, leading to informed decision-making.

Seamless system integrations

Intelligent automation options can optimize insurance companies’ business processes by directly integrating with existing systems.

For instance, boost.ai’s conversational AI can integrate with platforms like Slack and WhatsApp for instant messaging, authentication programs like Signicat and OpenID, and live chat platforms like Zendesk and Salesforce to create smoother user experiences.

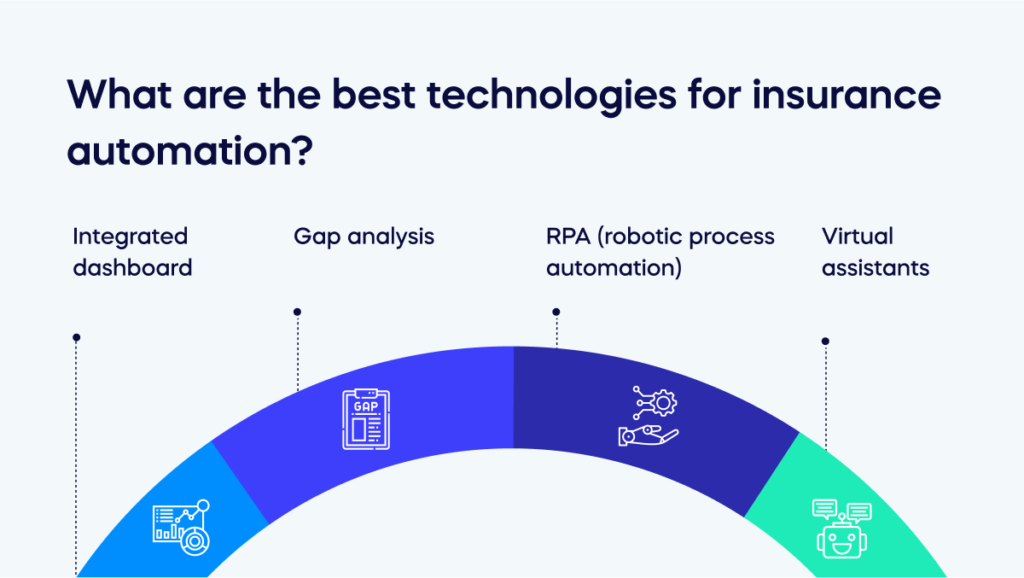

What are the best technologies for insurance automation?

Take a look at this list of the best technologies for insurance automation to help you identify the best tools to invest in to streamline processes and save resources.

Integrated dashboard

A dashboard app is a helpful tool for managing information. It can combine data from various sources to create charts, graphs, or summaries that provide a clear visual overview of performance for individuals or companies.

However, it requires data input from somewhere, and you can automate this process for efficient results.

Push spreadsheet data to a dashboard tool,

Create a workflow that extracts and displays information from your spreadsheet on your chosen dashboard app.

Push app data to a dashboard tool

Utilize dashboards apps to keep track of and showcase any information that is important to you.

Post company activity to a dashboard timeline

Establish automation that collects data from various sources and displays them on a dashboard timeline. This way, you can see everything happening in one place.

Gap analysis

Use gap analysis to evaluate how well an insurance business unit meets its goals or requirements. Automating this process improves efficiency and helps you review performance regularly using fewer resources.

RPA (robotic process automation)

The insurance industry benefits from RPA by automating high-volume data processing tasks.

RPA is well-suited for this industry because it can automate the entire process lifecycle, from integrating new front-end technologies with backend environments to completing the necessary tasks.

Virtual assistants

Using automation tools can assist virtual assistants in sending more accurate invoices delivered on time to clients, ultimately improving their chances of receiving payment on schedule.

Furthermore, automation in accounting can handle the task of reminding clients when bills are past due, which may not be a desirable task but is sometimes necessary.

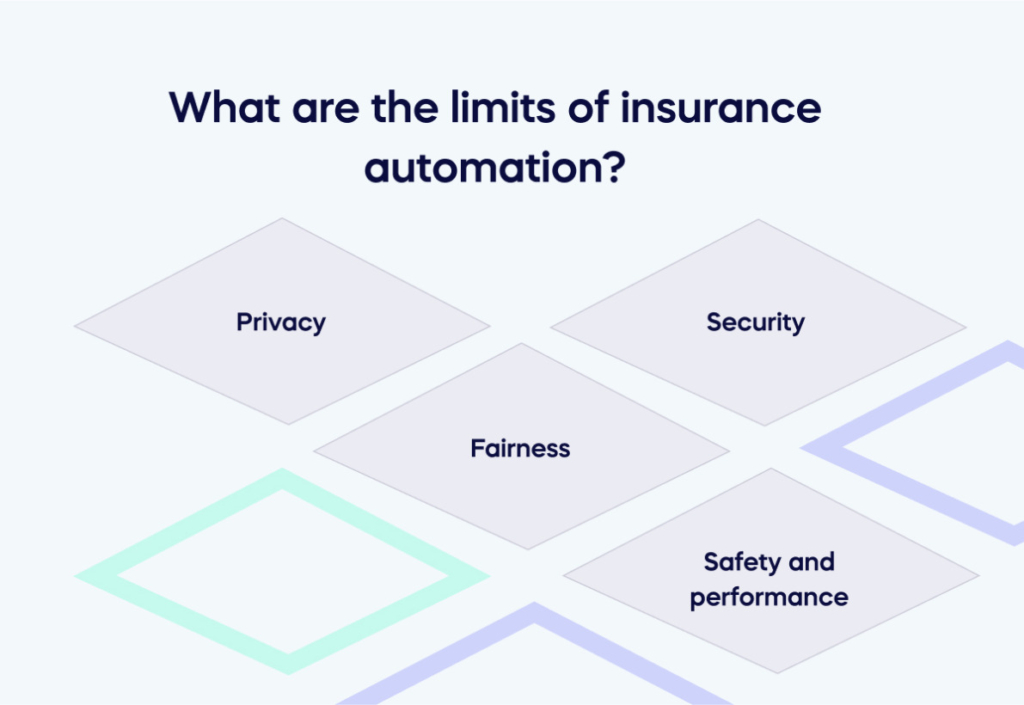

What are the limits of insurance automation?

Since the beginning of the COVID-19 pandemic, businesses have rapidly increased their adoption of digitization and automation with machine learning and other technologies.

According to a McKinsey survey of top executives, over two-thirds of companies have accelerated their implementation of these technologies.

It often seems to top executives that AI can solve all an organization’s problems, but this is not the case, as AI has many risks and limits.

Consider these limits before investing in insurance automation:

- Privacy: Privacy risks become higher with automation.

- Security: Security risks increase with the presence of automation.

- Fairness: Minimize impact on deployment and infrastructure.

- Safety and performance: Consider legal issues and regulatory compliance for automation.

It is essential to consider all these limits when planning how insurance automation can benefit your organization.

Consider limits and benefits before investing in insurance automation

Insurance automation is a great tool to streamline the insurance process while gaining efficiency, but it’s essential to consider its powers and limitations.

Automation can help by ensuring up-to-date policy management rules are compliantly applied. Still, in some instances, it can remove discretionary judgment, which could be beneficial in an uncertain economic environment.

Like any technology, you must manage it appropriately to ensure you gain the benefits of automated processes without paying for unnecessary extra steps or features and implementing insurance automation.

Ultimately, one should consider all the limits and full range of benefits of investing in insurance automation before making any decisions or investing in automation platforms.