After leading Royal Bank of Canada (RBC) through a digital transformation that successfully improved its customer support, it is no surprise that Tracy Metzger will be a featured speaker at a conference focused on discovering the best technology and enterprise solutions for financial companies.

Next month, RBC’s Senior Manager Business Digital Channels, Tracey Metzger, will be speaking at the 2017 T3 Advisory Conference. At the conference Tracey will discuss the journey RBC took to improve the bank’s customer support by providing a simpler support experience.

In preparation for the conference, Emilia D’Anzica, VP Customer Engagement at WalkMe, connected with Tracey to touch base on the challenges RBC faced and benefits she has experienced in leveraging WalkMe’s Digital Adoption Platform (DAP) for customer support.

In addition, RBC wanted a support tool that is flexible and easily applied to future enhancements.

One of the challenges was locating a vendor that allowed for the tight security that many financial institutions follow. A self-hosted model was an option from WalkMe, indicating that they were able to accommodate our requirements.

In addition, RBC wanted a support tool that is flexible and easily applied to future enhancements.

One of the challenges was locating a vendor that allowed for the tight security that many financial institutions follow. A self-hosted model was an option from WalkMe, indicating that they were able to accommodate our requirements.

Table of Contents

hide

Claim your free demo now to see how WalkMe can positively impact customer support for your banking institution.

Emilia D’Anzica: As a fellow Canadian, I grew up with Royal Bank of Canada, but for those new to the bank, can you tell us a little about the institution?

Tracey Metzger: RBC is one of Canada’s largest banks and one of the largest banks in the world, based on market capitalization. We are one of North America’s leading diversified financial services companies, and provide personal and commercial banking, wealth management, insurance, investor services and capital markets products and services on a global basis. We have over 80,000 full- and part-time employees who serve more than 16 million personal, business, public sector and institutional clients through offices in Canada, the U.S. and 36 other countries.Emilia: What challenges are RBC and other banking institutions facing in regards to digital customer support?

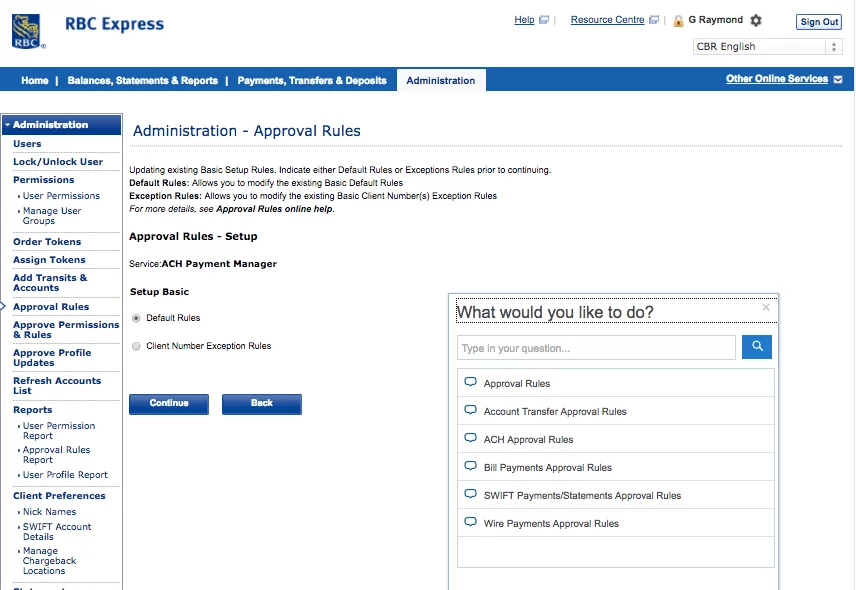

Tracey: As day-to-day business activities become more dependent on the digital channels, confusion and complexity have increased dramatically. RBC’s business banking and treasury platform, RBC Express Online Banking, needed a solution to help our clients navigate and transact in the platform. To meet client’s evolving expectations while we work on improving the overall user experience, RBC needed to provide self-help and training in a way that is easy and intuitive for clients.Emilia: At the beginning of the process of finding a solution, what were you looking for? What was important?

Tracey: RBC wanted to develop an “in-the-moment help” tool for RBC Express online banking users, providing accurate and relevant page/field level help to improve users’ ability to self-resolve their questions and thereby reduce calls to our Call Centre, and reduce requests for higher cost one-on-one training. We wanted to be able to anticipate the wants and needs of our clients who are setting up administration functions on the site, and also guide them step-by-step when performing financial transactions. In addition, RBC wanted a support tool that is flexible and easily applied to future enhancements.

One of the challenges was locating a vendor that allowed for the tight security that many financial institutions follow. A self-hosted model was an option from WalkMe, indicating that they were able to accommodate our requirements.

In addition, RBC wanted a support tool that is flexible and easily applied to future enhancements.

One of the challenges was locating a vendor that allowed for the tight security that many financial institutions follow. A self-hosted model was an option from WalkMe, indicating that they were able to accommodate our requirements.