Strategic portfolio management has been coined as the future of business continuity planning. It is the process of aligning strategic initiatives with organizational objectives, resources, and capabilities to maximize value delivery.

This is accomplished by continuously assessing, balancing, and optimizing portfolios of initiatives to ensure that resources are properly allocated according to their potential for maximizing return on investment.

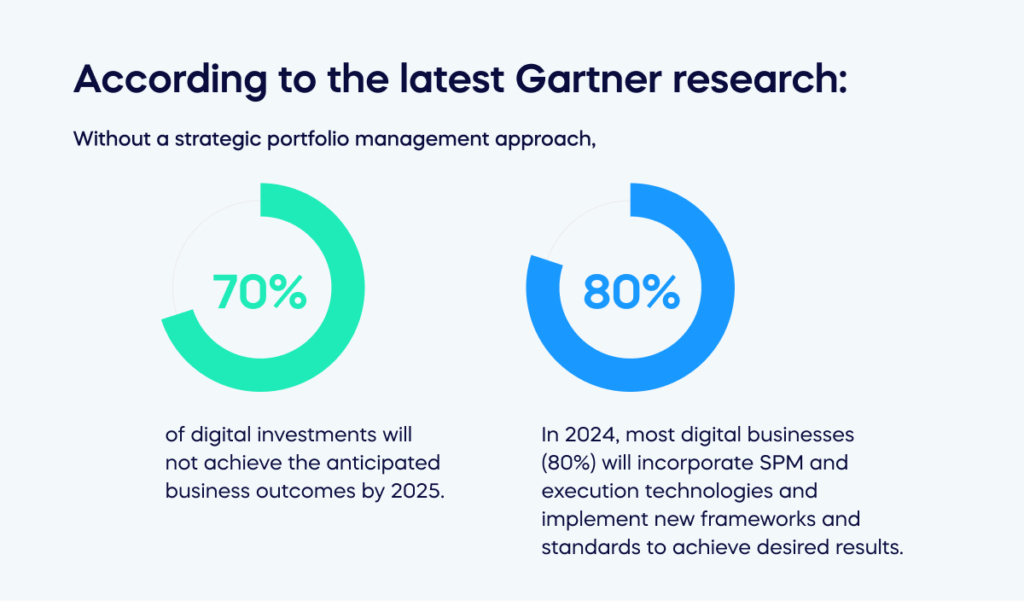

According to the latest Gartner research:

- Without a strategic portfolio management approach, 70% of digital investments will not achieve the anticipated business outcomes by 2025.

- In 2024, most digital businesses (80%) will incorporate SPM and execution technologies and implement new frameworks and standards to achieve desired results.

Strategic portfolio management requires understanding the organization’s strategy, value drivers, and change initiatives. It is also based on an understanding of industry trends and competitive pressures.

Strategic portfolio management (SPM) provides valuable insights that can help simplify the process of making tough decisions and putting them into action. People with a broader perspective of organizations understand that balancing competing needs can be challenging, keeping overarching objectives focused and efficiently executing plans on the ground.

Strategic portfolio management is the solution for this situation. It allows organizations to identify their most valuable initiatives and determine the best path for achieving desired outcomes. This approach incorporates various techniques, including portfolio analysis, value-based decision-making, integrated risk management, and scenario planning.

Ultimately, organizations can effectively align their resources and capabilities through strategic portfolio management to maximize value delivery and increase overall organizational performance. By leveraging this approach, organizations can make informed decisions to improve outcomes.

This article provides a comprehensive overview of strategic portfolio management, the key elements included in this approach, and how it can be leveraged to improve organizational performance.

What is strategic portfolio management?

Strategic portfolio management is how an organization chooses, orders, and manages its resources across programs, projects, and initiatives. This is done with the aim of achieving the organization’s strategic goals and objectives.

In today’s dynamic business landscape, the recipe for success lies in an organization’s ability to navigate an ever-changing tide of goals and objectives. But finding a way to balance implementing change, maintaining current initiatives, and maximizing ROI can be a real challenge.

Strategic portfolio management offers a framework for businesses to optimize their investments and improve processes. By leveraging this approach, companies can stay ahead of the curve, push past the competition and ensure long-term growth.

As such, implementing a portfolio management strategy is no longer a luxury but a necessity for companies looking to thrive amidst the rapidly-evolving business terrain.

Strategic portfolio management is valuable because it:

- Facilitates precise and comprehensive communication while enabling executives to obtain profound insights.

- Enables efficient communication of timelines, dependencies, and budgets among various groups within the company until the task is finished.

- Utilizes current project data from an organization to provide specific business intelligence data.

Still wondering what strategic portfolio management is? Here are the main ways companies benefit from it.

Strategic portfolio management benefits

In today’s dynamic business landscape, continuously adapting and optimizing investments is critical for organizations looking to stay ahead of the competition.

Strategic portfolio management gives companies the tools and insights to prioritize tasks effectively and achieve their strategic goals. By employing Agile and intelligent systems capable of responding in real time, organizations can unlock a wealth of benefits to guide their initiatives.

These include:

- Better resource allocation: One of the most significant benefits of strategic portfolio management is optimizing resource allocation. By implementing a strategic portfolio management system, organizations can prioritize and allocate resources to the projects with the highest potential ROI. This ensures that resources are used efficiently and contribute to the company’s overall strategic objectives. For example, by focusing resources on projects that align with the company’s long-term goals, organizations can avoid wasting resources on initiatives not aligned with their overall strategy.

- Improved risk management: Strategic portfolio management helps organizations assess and manage risk at a portfolio level rather than on a project-by-project basis. This approach enables organizations to identify potential risks and take steps to mitigate them, reducing the impact of risk on individual projects and the portfolio as a whole. For example, by implementing a risk management framework, organizations can identify and prioritize risks, develop mitigation strategies, and monitor and control risk throughout the portfolio.

- Increased transparency and accountability: Strategic portfolio management provides a clear view of all projects and their progress, allowing stakeholders to track their performance against strategic goals and hold teams accountable for delivering results. This transparency helps to create a culture of accountability and ensures that all projects are aligned with the organization’s strategic objectives. By providing visibility into project progress, decision-makers can make data-driven decisions that will positively impact the entire organization.

- Better decision-making: By providing real-time data and insights, strategic portfolio management enables organizations to make informed decisions about allocating resources and adjusting strategies to optimize their portfolio. This is particularly important because business landscapes are constantly evolving, and organizations must be able to adapt to stay competitive. With real-time data at their fingertips, decision-makers are better equipped to make the right choices and pivot quickly when necessary.

- Higher ROI: Perhaps the most significant benefit of strategic portfolio management is improving overall ROI by selecting and prioritizing projects that align with strategic objectives and have the highest potential impact. This results in more efficient use of resources and greater returns for the organization. For example, by conducting a portfolio analysis and prioritizing high-potential initiatives, organizations can focus on projects likely to have the greatest impact on the business, resulting in a higher ROI.

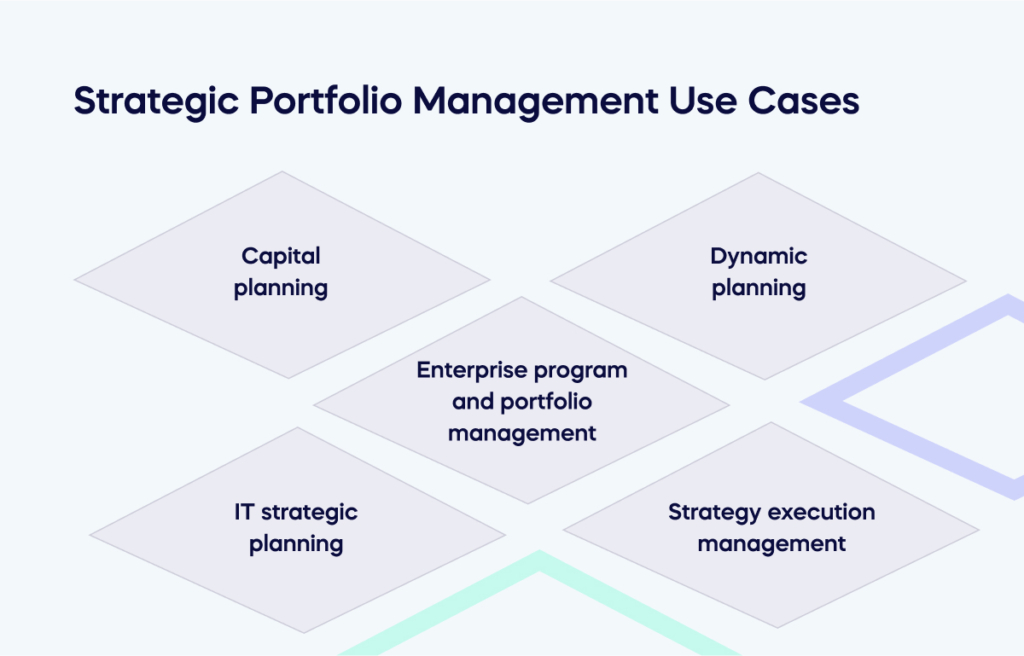

Strategic Portfolio Management Use Cases

Learn how organizations utilize strategic portfolio management to lead transformational change, monitor performance, and measure progress for faster strategy delivery with a well-defined plan.

Capital planning:

Capital planning involves identifying, evaluating, and selecting capital investments to support an organization’s strategic objectives. It involves analyzing the cost and benefits of potential projects, assessing risk, and selecting projects that align with the organization’s long-term goals.

Capital planning is typically done at an enterprise level, and it involves cross-functional collaboration and input from key stakeholders to ensure projects are aligned with the company’s overall strategy.

Dynamic planning:

Dynamic planning is an iterative process of continuously evaluating and adjusting plans in response to changing business needs. It involves developing a flexible planning framework that enables organizations to react quickly to market changes, customer needs, and other factors that impact the business.

Dynamic planning relies on real-time data and analytics to inform decision-making and prioritize initiatives, ensuring that resources are allocated efficiently and effectively.

Enterprise program and portfolio management:

Enterprise program and portfolio management (EPPM) is a process for managing multiple portfolios and programs across an entire organization. It involves establishing a governance framework that aligns projects with strategic goals, defines key performance metrics, and ensures resources are used effectively.

EPPM enables organizations to optimize resource allocation and achieve greater efficiency and effectiveness by prioritizing key initiatives, managing risk, and ensuring the visibility of program and portfolio performance.

IT strategic planning:

IT strategic planning involves developing a plan for IT investments and initiatives that aligns with the organization’s overall strategic goals. It involves identifying IT capabilities required to support business objectives, evaluating the costs and benefits of potential investments, and prioritizing initiatives based on business value.

IT strategic planning is essential to ensure that IT investments and resources are aligned with company goals and that the IT organization delivers optimal value to the broader enterprise.

Strategy execution management:

Strategy execution management involves managing the execution of initiatives across the organization, ensuring that they are executed on time and within budget and deliver the desired outcomes. It consists in establishing key performance metrics, monitoring progress, identifying and mitigating risks, and ensuring that resource allocation remains aligned with strategic goals.

Strategy execution management helps organizations achieve their strategic objectives by providing a framework for implementing and tracking initiatives across all company levels.

Providing extensive data for effective solution development

Your company can improve its strategy execution process by using a better method instead of relying on spreadsheets and static program tracking tools, especially if you have a large portfolio.

Providing comprehensive data to develop effective solutions is essential for strategic portfolio management. It involves collecting, organizing, and analyzing information on initiatives, costs, risks, and resource allocation. This allows organizations to pinpoint areas of opportunity and develop better strategies for executing projects that align with business objectives.

Effective capital planning and strategy execution management are critical in helping organizations reach their long-term goals. By leveraging the right tools, processes, and data to inform decision-making, organizations can ensure that their resources are allocated efficiently and effectively and that their initiatives align with their strategic objectives.