What is Benefits Enrollment?

Benefits enrollment, also known as open enrollment or benefits election, refers to the process through which employees choose and sign up for the employee benefits offered by their employer. These benefits often include health insurance, dental insurance, vision insurance, life insurance, retirement plans, and similar.

Table of contents

- What is Benefits Enrollment?

- What is open enrollment?

- Typical benefits for employees

- Changing benefits outside of open enrollment

- Advantages of benefits enrollment

- How to choose an employee benefits enrollment platform

- How to make employees aware of benefits enrollment

- How to set up and manage employee benefits enrollment plans

Benefits enrollment is a crucial aspect of the employer-employee relationship, allowing individuals to tailor their benefits to their unique needs and circumstances.

It also ensures that employees have access to important financial and healthcare resources.

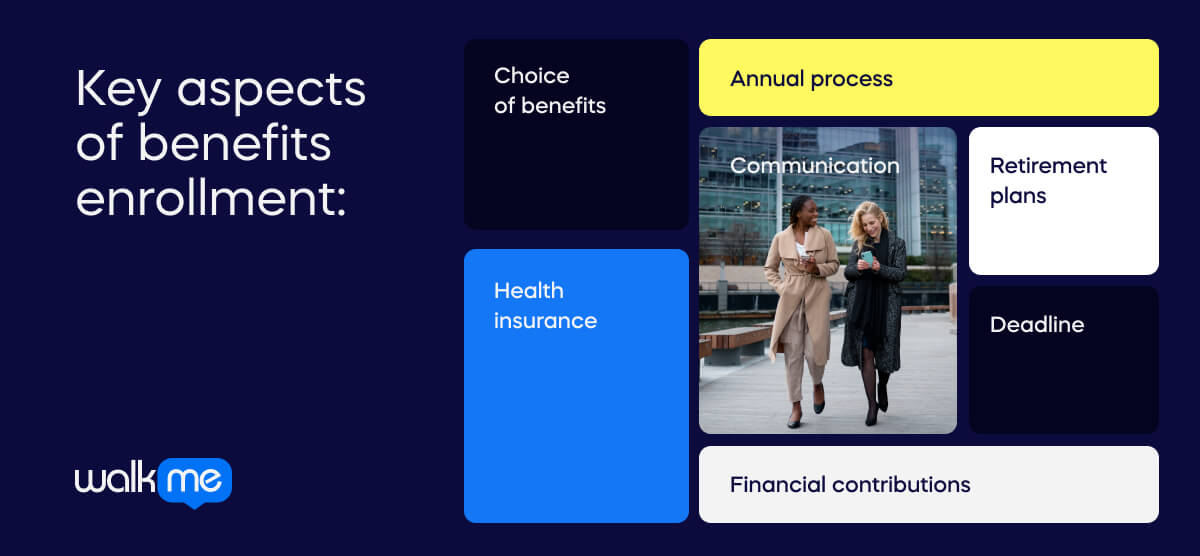

Here are some key aspects of benefits enrollment:

Annual process

In many organizations, benefits enrollment occurs once a year during an open enrollment period.

During this time, employees can review their current benefit selections, make changes, and choose new options if needed.

Choice of benefits

Employees are typically provided with a range of benefit options.

They may need to choose the level of coverage, select specific plans, and indicate their preferences for various benefits based on their individual or family needs.

Health insurance

One of the most crucial aspects of benefits enrollment is health insurance.

Employees may need to choose between different health plans and decide on coverage levels and options.

Financial contributions

Employees may be required to contribute financially to some of their benefits, such as health insurance premiums or retirement plan contributions.

The benefits enrollment process often includes decisions about these financial aspects.

Retirement plans

Benefits enrollment also includes decisions related to retirement plans.

Employees may choose their contribution amounts and investment options.

Communication

Employers typically provide communication materials, such as brochures, online resources, and presentations.

These help employees understand their benefit options and make informed decisions.

Deadline

Open enrollment periods have deadlines, and employees must complete their benefits selections within the specified timeframe.

Failure to do so may result in the default selection of certain benefits or missed opportunities.

What is open enrollment?

Open enrollment refers to a designated period during which employees can enroll in or make changes to their employee benefits.

This period usually occurs annually, allowing employees to review and update their benefit selections based on their changing needs or circumstances.

Open enrollment is an opportunity for employees to choose health insurance plans, adjust retirement contributions, and select other voluntary benefits offered by their employer.

This timeframe is crucial for both employers and employees. It allows for the alignment of benefits with individual needs, promotes financial planning, and ensures that employees have access to necessary healthcare and other benefits.

It is essential for employees to carefully review their options during this period to make informed decisions about their benefits.

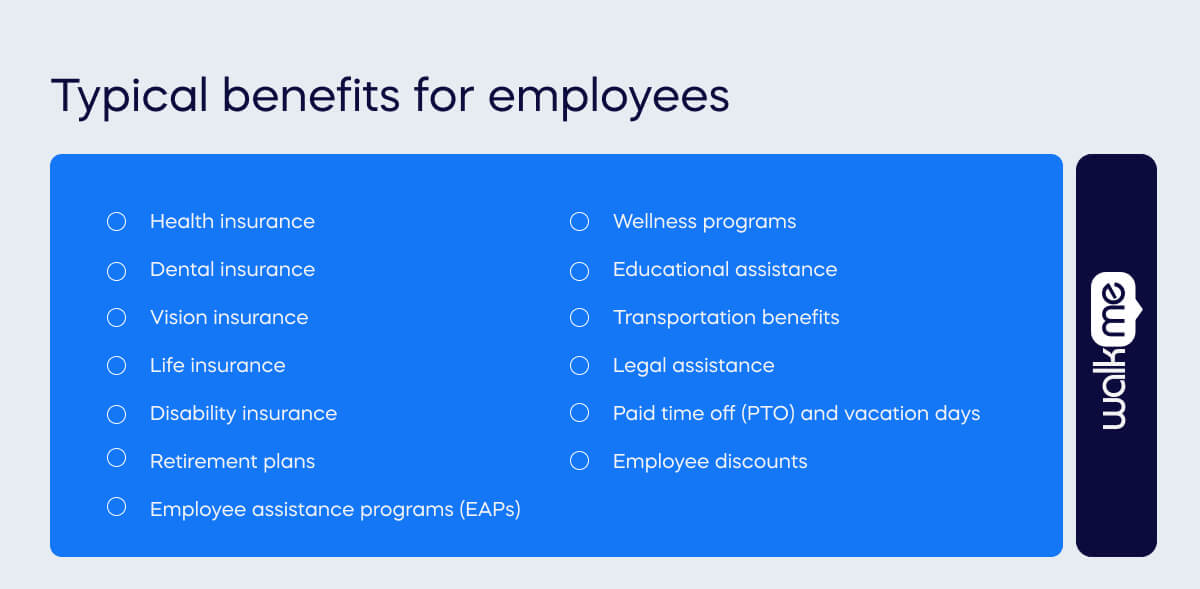

Typical benefits for employees

Employees typically have the opportunity to enroll in various benefits during open enrollment.

It’s important for employees to carefully review the benefits offered by their employer, considering their individual and family needs.

According to the Reward Management Survey by CIPD, the most popular employee benefits include EAPs (76%), eye healthcare (63%), and a workplace pension (62%).

Here are some common benefits:

Health insurance

- Health maintenance organization (HMO)

- Preferred provider organization (PPO)

- High deductible health plan (HDHP)

- Health savings account (HSA)

- Flexible spending account (FSA)

According to WTW’s Global Benefits Attitudes Survey, health benefits are one of the main factors influencing employee attraction and retention.

Dental insurance

- Coverage for routine check-ups, cleanings, and dental procedures

Vision insurance

- Coverage for eye exams, eyeglasses, and contact lenses

Life insurance

- Basic life insurance coverage

- Optional supplemental life insurance for the employee and dependents

Disability insurance

- Short-term disability coverage

- Long-term disability coverage

Retirement plans

- 401 (k) or other employer-sponsored retirement plans

- Employer matching contributions

Employee assistance programs (EAPs)

- Counseling services and support for various life issues

Wellness programs

- Gym memberships

- Health screenings

- Incentives for healthy behaviors

Educational assistance

- Tuition reimbursement or assistance for job-related education

Transportation benefits

- Commuter benefits for public transportation or parking expenses

Legal assistance

- Legal services for certain personal or family matters

Paid time off (PTO) and vacation days

- Paid holidays, vacation time, and sick leave

Employee discounts

- Discounts on company products or services and partnerships with other businesses

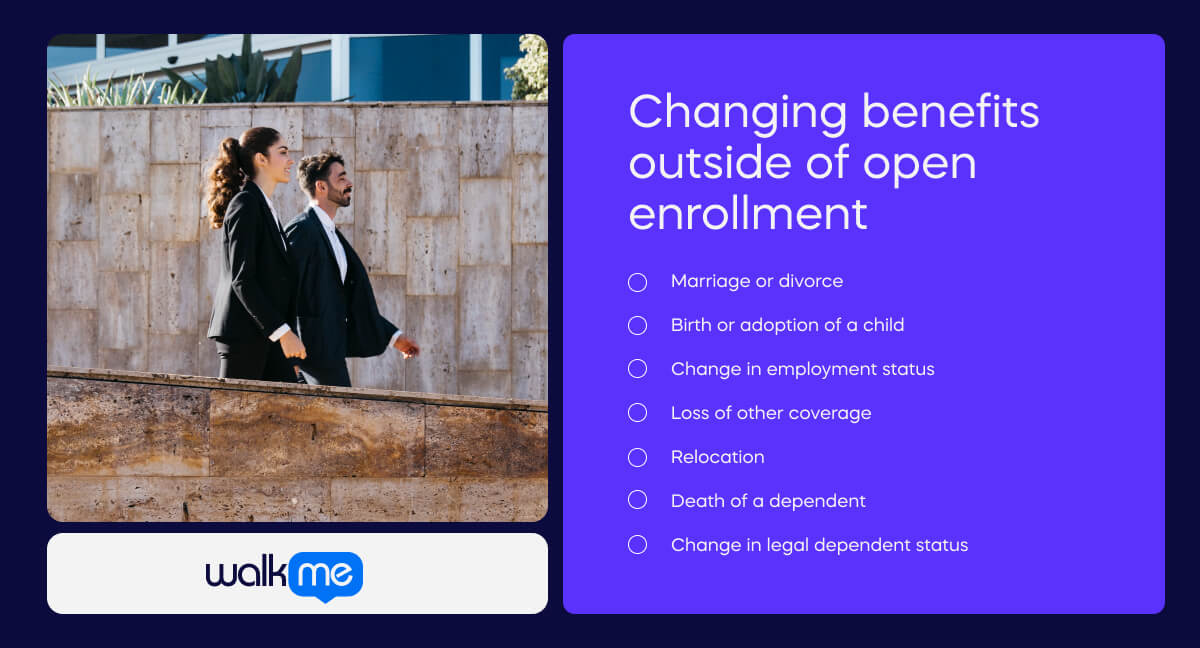

Changing benefits outside of open enrollment

In general, employee benefits are often set during an annual open enrollment period, and changes made during this time typically take effect at the beginning of the next plan year.

However, certain circumstances may allow employees to make changes to their benefits outside of the open enrollment period.

These situations are often referred to as qualifying life events or life change events.

Employees typically have a limited window of time (usually a set number of days) from the qualifying life event date to make changes to their benefits.

They can contact their employer’s HR department during this period to initiate the necessary changes.

Common qualifying life events that may allow employees to change their benefits during the year include:

Marriage or divorce

Getting married or divorced can be a qualifying event that allows employees to make changes to their benefits.

Birth or adoption of a child

Adding a new dependent through birth or adoption may qualify an employee to change health insurance, life insurance, and other benefits.

Change in employment status

Significant changes in employment, such as a change in employment status (full-time to part-time or vice versa), may trigger a qualifying life event.

Loss of other coverage

If an employee or their dependents lose coverage from another source (e.g., spouse’s employer, Medicaid), they may qualify for a special enrollment period.

Relocation

Moving to a new location outside the coverage area of the current health plan may be considered a qualifying event.

Death of a dependent

The death of a covered dependent may allow for adjustments to benefits.

Change in legal dependent status

Eligibility for benefit adjustments may arise from legal changes, like gaining custody of a child or experiencing a shift in legal dependent status.

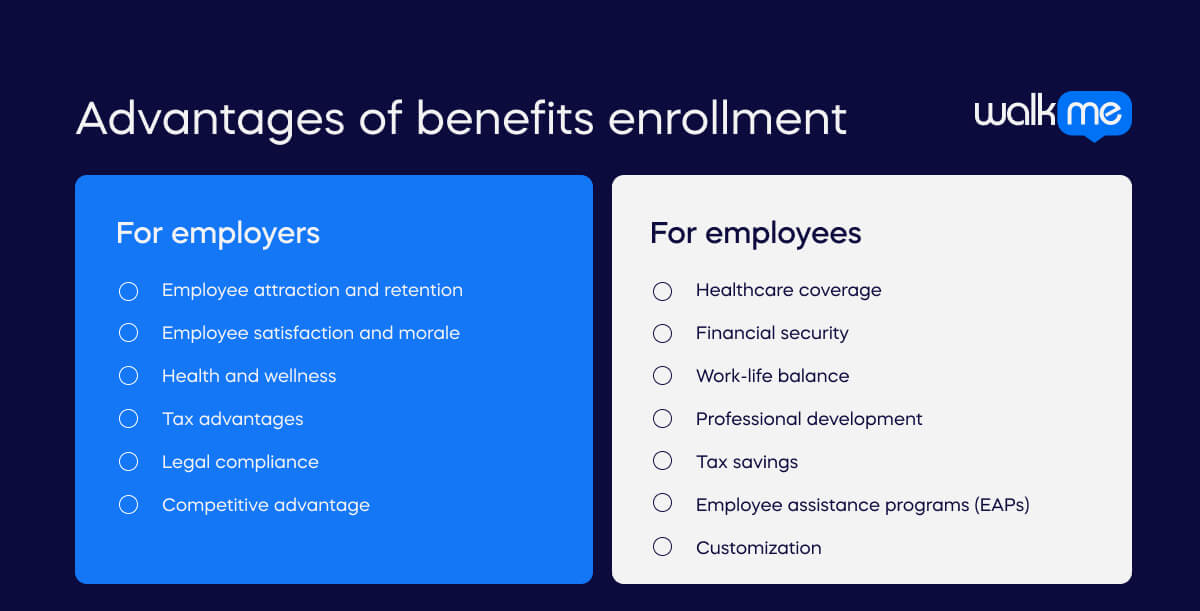

Advantages of benefits enrollment

Benefits enrollment offers several advantages for both employers and employees.

Here are some competitive employee benefits:

For employers

Employee attraction and retention

A comprehensive benefits package can make a company more attractive to potential employees and help retain current staff.

Competitive benefits can be a significant factor in talent acquisition and retention strategies.

Employee satisfaction and morale

Providing a variety of benefits tailored to employees’ needs can contribute to higher job satisfaction and morale.

This may lead to increased employee productivity and a positive work environment.

Health and wellness

Health insurance and wellness programs can contribute to a healthier workforce.

Healthy employees may experience fewer sick days and be more engaged and productive at work.

Tax advantages

Certain employee benefits, such as contributions to retirement plans and health savings accounts, may have tax advantages for both employers and employees.

Legal compliance

Offering benefits that comply with legal requirements and regulations helps employers meet their legal obligations and avoid potential penalties.

Competitive advantage

A robust benefits package provides employers with a competitive edge in the job market and distinguishes them from competitors, positioning them as employers of choice.

For employees

Healthcare coverage

Access to health insurance helps employees manage healthcare costs, including doctor visits, prescription medications, and preventive care.

Financial security

Benefits such as life insurance, disability insurance, and retirement plans contribute to employees’ financial security and help them plan for the future.

Work-life balance

Benefits, like paid time off, flexible scheduling, and family leave options, contribute to a better work-life balance, improving overall well-being.

Professional development

Educational assistance programs and training opportunities support employees in their professional development, enhancing their skills and career prospects.

Tax savings

Certain benefits, such as contributions to retirement and flexible spending accounts, may give employees tax advantages, helping them save on taxes.

Employee assistance programs (EAPs)

EAPs offer resources for managing personal and work-related challenges promoting mental health and well-being.

Customization

Benefits enrollment allows employees to tailor their benefits to their needs, ensuring they receive coverage that aligns with their circumstances.

How to choose an employee benefits enrollment platform

Selecting an employee benefits enrollment platform is an important decision that can impact employers and employees.

Here are key considerations to help you select the right setup for your organization:

Understand your needs

To effectively identify your organization’s specific needs and priorities, consider factors such as the size of your workforce, the complexity of your benefits offerings, and any unique requirements.

Ease of use

Choose a platform that is user-friendly for both administrators and employees. The enrollment process should be intuitive, with clear instructions and minimal complexity.

Integration with HR systems

Ensure seamless integration of the benefits enrollment platform with your existing HR systems, including payroll, time and attendance, and other HR management tools. This integration aids in streamlining processes and minimizing manual data entry efforts.

Customization options

Look for a platform that allows customization of benefit plans based on the diverse needs of your workforce. Employees should be able to choose from various plan options and coverage levels.

Mobile accessibility

In today’s mobile-centric environment, consider a platform that is mobile-friendly. This allows employees to access and complete the enrollment process from their smartphones or tablets.

Communication features

Choose a platform that facilitates effective communication between administrators and employees.

Communication tools can include email notifications, alerts, and reminders about important enrollment deadlines.

Decision support tools

Some platforms offer decision support tools that help employees make informed choices about benefits. These tools may include calculators, educational resources, and interactive guides.

Compliance and security

Ensure that the platform is in compliance with relevant regulations and industry standards, such as data security and privacy laws. Security measures should be in place to protect sensitive employee information.

Reporting and analytics

Look for a platform that provides robust reporting and analytics features. This can help HR professionals track enrollment trends, analyze data, and make informed decisions about benefits offerings.

Scalability

Choose a platform that can scale with the growth of your organization. It should accommodate changes in the number of employees and adapt to evolving benefits needs.

Vendor reputation and support

When researching a benefits enrollment platform vendor, delve into their reputation by examining reviews, testimonials, and customer references. Evaluate the level of customer support and training the vendor offers to make an informed decision.

Cost considerations

Understand the pricing structure of the platform, including any setup fees, subscription costs, or additional charges, and consider the overall value and return on investment.

Employee education and support

Evaluate the platform’s ability to provide educational resources and support to employees during the enrollment process. This can include FAQs, tutorials, and live support options.

Feedback mechanism

Choose a platform that allows for employee feedback and surveys. This can help assess the effectiveness of the enrollment process and identify areas for improvement.

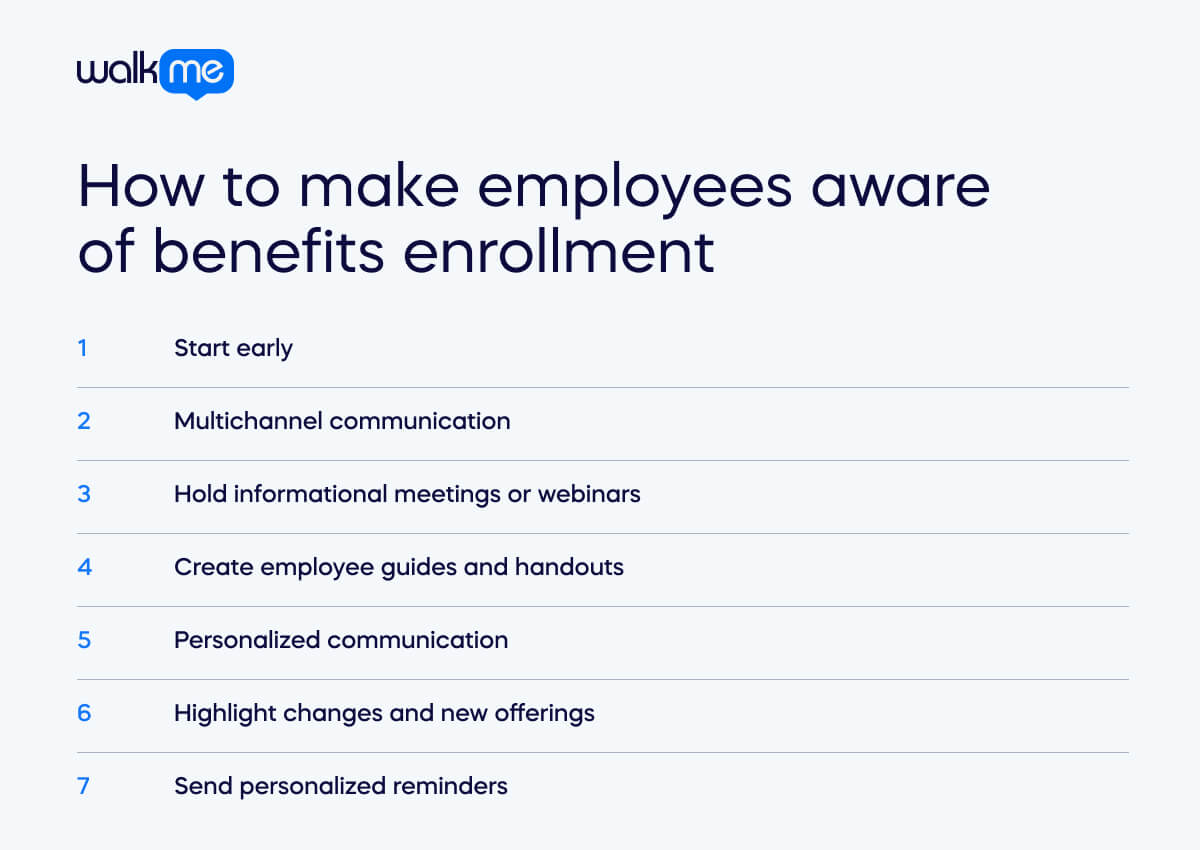

How to make employees aware of benefits enrollment

Effectively communicating benefits enrollment information to employees is crucial to ensure they know their options and can make informed decisions.

Here are some strategies to make employees aware of benefits enrollment:

Start early

Begin communication well in advance of the open enrollment period. This gives employees ample time to gather information, ask questions, and make informed decisions.

Multichannel communication

Use a variety of communication channels to reach employees. This may include email, company newsletters, intranet or employee portal announcements, posters in common areas, and digital signage.

A multichannel approach ensures that the message reaches employees through different mediums.

Hold informational meetings or webinars

Conduct informational meetings or webinars to review the benefits options and changes for the upcoming enrollment period. This provides employees with an opportunity to ask questions and seek clarification.

Create employee guides and handouts

Create accessible guides or handouts that elucidate benefits options, changes, and the enrollment process. Employ clear language and incorporate visual aids to enhance the digestibility of the information.

Personalized communication

Tailor communication to specific employee groups or demographics. For example, consider the needs of different age groups, family statuses, or departments when crafting messages.

Highlight changes and new offerings

Communicate any changes to existing benefits and introduce new offerings. Emphasize how these changes may impact employees and why they are being implemented.

Send personalized reminders

Send personalized reminders through various channels as the enrollment deadline approaches. Emphasize the importance of reviewing and updating benefit selections before the deadline.

How to set up and manage employee benefits enrollment plans

Setting up and managing employee benefits enrollment plans involves several key steps.

Here is a comprehensive guide to help you navigate the process:

Assess organizational needs

- Understand the demographics and needs of your workforce.

- Identify the types of benefits that would be most valuable to employees.

Compliance check

- Familiarize yourself with relevant employment laws and regulations.

- Ensure that your benefits plans comply with legal requirements.

Select benefit options

- Choose the types of benefits to offer, such as health insurance, dental and vision plans, retirement plans, life insurance, disability coverage, and other voluntary benefits.

- According to Drewberry, 25% of employees aren’t satisfied with their employer benefits. This means it’s more important than ever to select benefits that will be of genuine use to the workforce.

Partner with benefit providers

- Establish relationships with benefit providers (insurance companies, retirement plan administrators, etc.).

- Negotiate terms, rates, and coverage details.

Design benefit packages

- Develop comprehensive benefits packages that meet the needs of diverse employee groups.

- Consider offering a range of coverage options and levels.

Technology and software

- Invest in benefits administration software or a platform that streamlines the enrollment process.

- Ensure the software integrates with other HR systems.

Employee communication

- Develop a communication strategy for benefits enrollment.

- Use various channels like email, newsletters, intranet, and in-person meetings to inform employees about the benefits offered.

Educational resources

- Provide educational materials, guides, and resources to help employees understand their benefit options.

- Consider hosting workshops or webinars to explain complex benefit offerings.

Open enrollment period

- Establish a specific open enrollment period during which employees can review and change their benefit selections.

- Communicate the start and end dates of the enrollment period.

Legal documentation

- Prepare and distribute legal documents, such as summary plan descriptions and other required disclosures.

- Ensure that employees receive clear information about their rights and responsibilities.

Enrollment system training

- Train HR staff and benefits administrators on the benefits enrollment system.

- Ensure they are familiar with troubleshooting common issues and providing support to employees.

Testing and feedback

- Conduct testing of the benefits enrollment system before the open enrollment period.

- Gather feedback from a sample of employees to identify and address any issues.

Record keeping

- Establish a system for accurate record keeping of benefit elections.

- Ensure that records are maintained securely and in compliance with data privacy laws.

Evaluate and adjust

- After the open enrollment period, evaluate the effectiveness of the process.

- Collect feedback from employees and HR staff to identify areas for improvement.

- Make necessary adjustments for the next enrollment period.