What is a MicroSurvey?

A MicroSurvey is a brief and targeted survey designed to concisely collect specific information from respondents.

Table of contents

- What is a MicroSurvey?

- Types of MicroSurvey

- What are the benefits of MicroSurveys?

- What are the drawbacks of MicroSurveys?

- Microsurveys vs traditional surveys

- How to use MicroSurveys with a DAP

- Examples of MicroSurveys

- Big businesses and MicroSurvey

- How to create and roll out MicroSurveys in business

Unlike traditional surveys that may be longer and cover a broader range of topics, MicroSurveys are characterized by their brevity and focused nature.

These surveys typically consist of a small number of questions, often limited to just a few, to gather quick insights or feedback on a specific topic.

Microsurveys are commonly used in various fields, including market research, customer feedback, employee engagement, and user experience.

Due to their short length, MicroSurveys are well-suited for situations with limited time and attention, making it more likely for people to participate and provide responses.

Organizations and researchers may use MicroSurveys as a tool to gather timely and relevant information without imposing a significant burden on respondents.

This type of survey is particularly popular in the age of digital communication, where short surveys can be easily distributed through various channels such as email, social media, or mobile apps.

According to Freshworks, 86% of consumers are more likely to continue purchasing from a company that values their feedback and actions once gathered.

Types of MicroSurvey

Here are examples of MicroSurveys with some commonly known frameworks:

CSAT (Customer Satisfaction Score)

CSAT MicroSurveys typically consist of one question asking customers to rate their satisfaction with a product or service on a scale, often ranging from “Very Dissatisfied” to “Very Satisfied.”

CES (Customer Effort Score)

CES MicroSurveys focuses on how customers can achieve their goals or resolve issues. The survey may include a single question like, “How easy was it for you to [complete a specific task]?”

NPS (Net Promoter Score)

NPS MicroSurveys usually involve a single question asking respondents how likely they are to recommend a product, service, or company to others. The responses are typically on a scale from 1 to 10.

PMF (Product-Market Fit)

PMF MicroSurveys aims to measure how well a product satisfies the needs of a specific market. Questions may include assessing the likelihood that users would be disappointed if the product were no longer available.

One-question employee engagement survey

In the context of employee engagement, a MicroSurvey may involve a single question like, “On a scale of 1 to 10, how motivated are you at work?” to quickly gauge employee satisfaction and engagement.

Quick social media poll

On social media platforms, MicroSurveys can be conducted through quick polls. For example, a company might ask its followers to vote on two product options by clicking a button for their preferred choice.

Single-question event feedback survey

After an event, organizers might use a MicroSurvey with a single question such as, “How likely are you to attend our future events?” to quickly capture participant feedback.

Emoji-based user experience survey

Instead of traditional rating scales, a MicroSurvey on user experience might use emojis to represent different satisfaction levels, making it more visually engaging for respondents.

Binary survey for quick feedback

A binary MicroSurvey could ask a simple yes/no question like, “Did you find the information you were looking for?” to quickly assess user satisfaction on a website.

Slider-based feedback on new feature

A MicroSurvey for feedback on a new software feature might use a visual slider for respondents to indicate their level of satisfaction or preference on a scale.

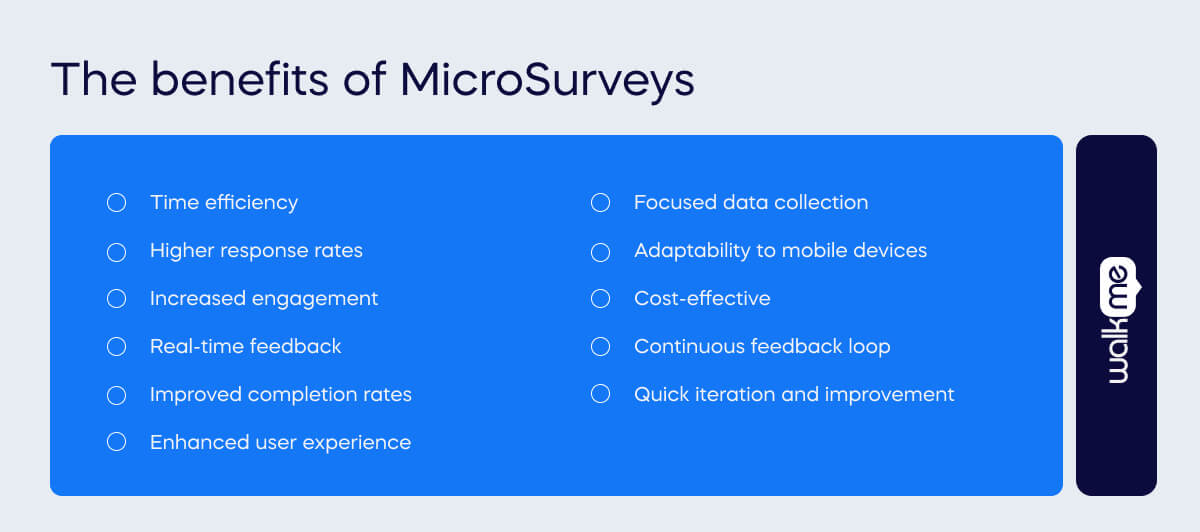

What are the benefits of MicroSurveys?

Microsurveys offer several benefits, making them popular for gathering quick insights and feedback in various contexts. Here are some key advantages of using MicroSurveys:

Time efficiency

Microsurveys are designed to be short and focused, saving respondents time. This makes them more likely to participate and provide accurate responses, especially in today’s fast-paced environment.

Higher response rates

Due to their brevity, MicroSurveys generally experience higher response rates compared to longer surveys. People are more willing to take a few minutes to answer a concise set of questions.

According to FluidSurveys, the average response rate can drop below 2% when there is no motivation to take email surveys. This indicates that MicroSurveys may assist with improving response rates due to their speediness and ease of access – as they appear while users are utilizing the product or service.

Increased engagement

The brevity and simplicity of MicroSurveys make them more engaging for respondents. They are less likely to be perceived as burdensome, leading to increased participation and more thoughtful responses.

Real-time feedback

Microsurveys can be deployed quickly and easily, allowing organizations to collect real-time feedback on specific events, interactions, or experiences. This enables swift decision-making and adjustments based on current information.

Improved completion rates

With fewer questions to answer, respondents are more likely to complete the entire survey. This helps obtain a higher percentage of completed responses and reduces survey abandonment.

Enhanced user experience

Microsurveys contribute to a positive user experience by respecting respondents’ time and attention. This can lead to a more favorable perception of the survey process and the organization conducting it.

Focused data collection

Microsurveys are designed with a specific goal in mind, allowing organizations to focus on collecting targeted information. This is particularly useful for obtaining insights on particular aspects of products, services, or experiences.

Adaptability to mobile devices

Given their short length, MicroSurveys are well-suited for completion on mobile devices. As mobile usage continues to rise, this adaptability ensures that surveys can reach a broader audience.

Cost-effective

Shorter surveys require fewer resources in terms of time and money to design, administer, and analyze. This makes MicroSurveys a cost-effective option for organizations with limited resources.

Continuous feedback loop

Microsurveys facilitate the establishment of a continuous feedback loop. Organizations can regularly check in with customers, employees, or users to stay informed about changing preferences, needs, or sentiments.

Quick iteration and improvement

Rapid deployment of MicroSurveys enables organizations to iterate quickly based on the feedback received. This agility is valuable for making timely improvements to products, services, or processes.

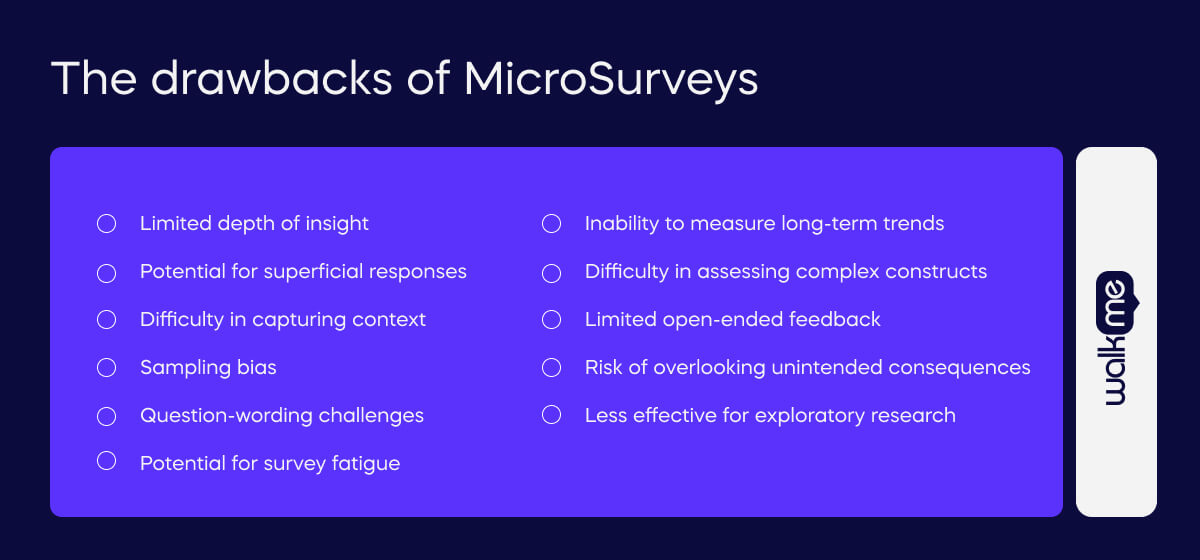

What are the drawbacks of MicroSurveys?

While MicroSurveys offer various advantages, they also come with some drawbacks. It’s essential to be aware of these limitations to make informed decisions about when and how to use them.

Here are some drawbacks:

Limited depth of insight

Due to their brevity, MicroSurveys may not provide in-depth insights into complex issues. They are best suited for collecting quick and specific information, but may not be sufficient for exploring nuanced or detailed topics.

Potential for superficial responses

Respondents may provide superficial answers due to the limited scope of questions in MicroSurveys. The brevity can lead to oversimplification of responses, especially when more detailed feedback is necessary.

Difficulty in capturing context

Microsurveys may struggle to capture the full context of a situation or experience. Without a comprehensive set of questions, it can be challenging to understand the reasons behind respondents’ choices or opinions.

Sampling bias

As with any survey method, MicroSurveys are susceptible to sampling bias. The results may not accurately represent the broader population if the survey is distributed to a specific subset.

Question-wording challenges

Crafting effective questions in a limited space is challenging. Ambiguous or poorly worded questions may lead to misinterpretation, affecting the reliability and validity of the survey results.

Potential for survey fatigue

While MicroSurveys aim to be less burdensome, frequent use of such surveys, especially by the same organization, can contribute to survey fatigue. Respondents may become less willing to participate over time.

Inability to measure long-term trends

Microsurveys may not be suitable for tracking long-term trends or attitude changes over an extended period. Continuous reliance on short surveys might miss the broader context of evolving opinions and behaviors.

Difficulty in assessing complex constructs

Certain constructs, such as overall satisfaction or complex attitudes, may be challenging to assess accurately with just a few questions. Comprehensive measurement often requires a more extensive survey instrument.

Limited open-ended feedback

Microsurveys typically do not include open-ended questions, limiting the ability to gather qualitative, detailed feedback. Valuable insights may be missed when respondents cannot express themselves in their own words.

Risk of overlooking unintended consequences

The focused nature of MicroSurveys may lead to overlooking unintended consequences or aspects not covered in the survey questions. This can be a risk when making decisions based solely on the information obtained from short surveys.

Less effective for exploratory research

Microsurveys are not well-suited for exploratory research, which aims to uncover new insights and patterns. Their structure is more aligned with confirmatory research seeking to validate specific hypotheses.

Microsurveys vs traditional surveys

Microsurveys and traditional surveys represent two different approaches to gathering information from respondents, each with advantages and disadvantages.

Here’s a comparison between MicroSurveys and traditional surveys:

| Microsurveys | Traditional surveys | |

| Length | Short and concise, typically a small number of questions | Longer and more comprehensive, often involving a larger set of questions |

| Time to complete | Quick, usually taking only a few minutes | Longer completion time may take more time and effort from respondents |

| Focus | Narrow and focused on specific topics or objectives | Broader in scope, covering a wide range of issues or dimensions |

| Response rates | Generally higher due to brevity | Response rates may be lower, as the length may deter respondents |

| Engagement | Tends to be more engaging due to its short and targeted nature | This may result in respondent fatigue, leading to decreased engagement |

| Real-time feedback | Ideal for collecting real-time feedback and immediate insights | May take longer to analyze, reducing the speed of obtaining feedback |

| Adaptability to mobile devices | Well-suited for mobile devices, aligning with the growing trend of mobile survey participation | May pose challenges on smaller screens, potentially affecting user experience |

| Cost-effectiveness | Often more cost-effective, requiring fewer resources for design, distribution, and analysis | Can be more resource-intensive in terms of time and budget |

| Depth of insight | Limited due to brevity | Allows for a more comprehensive exploration of topics, providing richer insights |

| Contextual understanding | May struggle to capture the full context of a situation | Provides a better opportunity to explore complex issues and understand nuances |

| Flexibility | Suitable for specific and targeted research objectives | More flexible and can be adapted for exploratory research or in-depth investigations |

| Measurement of complex constructs | May face challenges in assessing complex constructs comprehensively | Better equipped to measure multifaceted concepts and attitudes |

| Long-term trend analysis | Less effective for tracking long-term trends | Enables measurement of changes and trends over an extended period |

| Open-ended feedback | Typically lacks open-ended questions | Allows for the collection of qualitative, detailed feedback through open-ended questions |

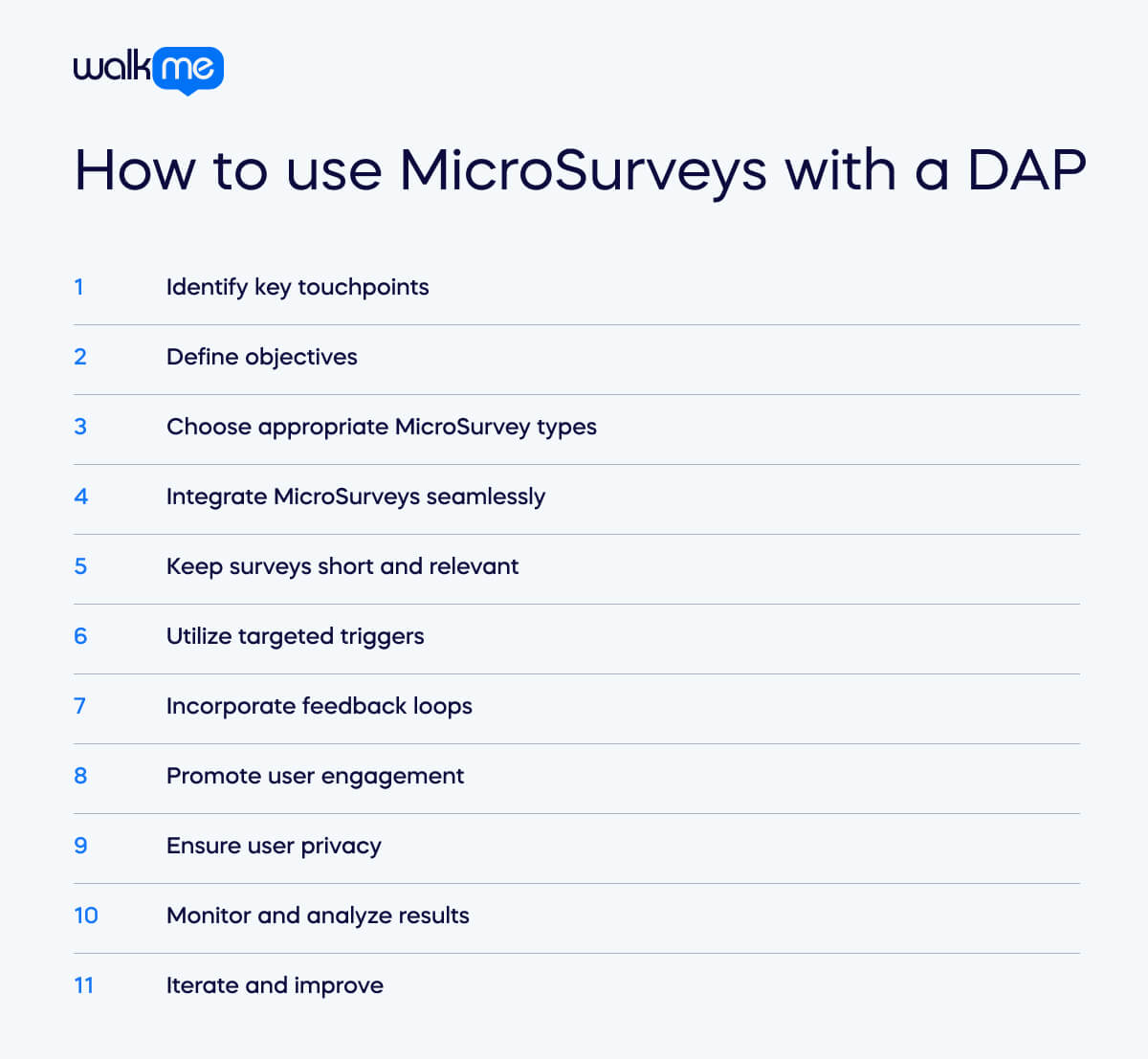

How to use MicroSurveys with a DAP

Integrating MicroSurveys with a Digital Adoption Platform (DAP) can be a strategic way to gather targeted feedback, identify user pain points, and improve the overall digital adoption experience.

Here’s a guide on how to use MicroSurveys with a Digital Adoption Platform:

Identify key touchpoints

Identify critical touchpoints within your digital adoption process where users interact with the Digital Adoption Platform. These touchpoints could include customer onboarding, feature introductions, or specific task workflows.

Define objectives

Clearly define the objectives of your MicroSurveys. Determine the specific insights or feedback you seek from users at each identified touchpoint. Whether it’s understanding user satisfaction, identifying challenges, or gathering suggestions for improvement, having clear goals is crucial.

Choose appropriate MicroSurvey types

Select MicroSurvey types that align with your objectives and the nature of the information you want to gather. For example, use Net Promoter Score (NPS) MicroSurveys for overall satisfaction, emoji-based surveys for quick sentiment analysis, or single-question surveys for specific feedback.

Integrate MicroSurveys seamlessly

Integrate MicroSurveys seamlessly within the Digital Adoption Platform. Ensure that the surveys appear at the right moment, such as after a user completes a task or when they are about to explore a new feature. The goal is to capture feedback in real-time and in context.

Keep surveys short and relevant

Given the MicroSurvey format, keep the questions short and relevant to the specific context. Users are more likely to provide feedback if the questions are concise and directly related to their recent interactions with the platform.

Utilize targeted triggers

Implement targeted triggers for MicroSurveys based on user behavior. For example, trigger a survey when a user spends an extended amount of time on a particular feature or when they repeat certain actions. This ensures that feedback is collected when users are actively engaged.

Incorporate feedback loops

Establish a feedback loop where insights gathered from MicroSurveys are used to inform improvements in the Digital Adoption Platform. Regularly review and analyze the collected data, and use it to iterate on the user experience, address pain points, and enhance features.

Promote user engagement

Encourage user engagement with MicroSurveys by making them visually appealing and user-friendly. Use images, emojis, or interactive elements to enhance the survey experience and increase participation.

Ensure user privacy

Prioritize user privacy and clarify how the collected feedback will be used. Assure users that their responses are anonymous if applicable, and emphasize that the goal is to enhance their experience with the Digital Adoption Platform.

Monitor and analyze results

Regularly monitor and analyze the results of MicroSurveys. Look for patterns, trends, and common themes in user feedback. Use the insights to make data-driven decisions and continuously optimize the Digital Adoption Platform.

Iterate and improve

Based on the feedback received, iterate on the Digital Adoption Platform. Implement improvements, address identified pain points, and adjust to enhance the overall user experience. The iterative process ensures ongoing optimization.

Examples of MicroSurveys

Microsurveys offer a powerful tool for businesses to gather targeted insights, enabling them to enhance user experiences, streamline processes, and optimize their products and services.

Below, we explore how various types of MicroSurvey could be applied by an e-commerce site.

Customer satisfaction (CSAT) MicroSurvey

An e-commerce site utilizes CSAT MicroSurveys to measure customer satisfaction after resolving an order-related inquiry through its customer support channel.

Net Promoter Score (NPS) MicroSurvey

The e-commerce site employs NPS MicroSurveys to gauge customer loyalty and the likelihood of customers recommending their platform after successful order deliveries.

User onboarding MicroSurvey

When introducing a new feature, the e-commerce site implements user onboarding MicroSurveys to evaluate how well customers adapt to and understand the new feature during their shopping experience.

Post-purchase experience MicroSurvey

After customers complete a purchase, the e-commerce site uses post-purchase MicroSurveys to assess satisfaction levels and identify any issues that may have arisen during the transaction.

Mobile app usability MicroSurvey

The e-commerce site deploys mobile app usability MicroSurveys to gather insights on the user-friendliness of their mobile app, ensuring a seamless shopping experience for mobile users.

Post-interaction MicroSurvey

After resolving a help desk ticket, the e-commerce site leverages post-interaction MicroSurveys to evaluate customer satisfaction and the effectiveness of the support provided.

Product-market fit (PMF) MicroSurvey

The e-commerce site employs PMF MicroSurveys to understand how well their products meet customer needs, helping them tailor their offerings to market demands.

Quick poll on social media

To engage with their online community, the e-commerce site conducts quick polls on social media to gather opinions on upcoming features or product releases.

Event registration experience MicroSurvey

When hosting online events or sales, the e-commerce site uses event registration MicroSurveys to assess the registration process’s user-friendliness and address any issues before the event.

Post-webinar feedback MicroSurvey

After conducting webinars on product launches, the e-commerce site collects post-webinar MicroSurvey feedback to understand how well the content meets customer expectations and informational needs.

Quick feedback on new design

Before fully implementing a redesigned homepage, the e-commerce site gathers quick feedback through MicroSurveys to ensure the new design aligns with user preferences and expectations.

Big businesses and MicroSurvey

Several big brands have utilized MicroSurveys as part of their strategies to gather quick feedback, improve customer experiences, and make data-driven decisions.

Here are five examples of how big businesses have incorporated MicroSurveys into their practices:

Apple

Apple frequently uses MicroSurveys to gather feedback on its products and services. For instance, after a customer support interaction, users might receive a short survey asking about their satisfaction with the assistance provided. Apple also uses in-app MicroSurveys to understand user preferences and identify areas for improvement.

Amazon

Amazon uses MicroSurveys to collect feedback on its website functionality, product recommendations, and the overall shopping experience. After a purchase, customers may receive a MicroSurvey asking about the delivery process or product satisfaction. Amazon leverages these insights to enhance its platform and tailor recommendations.

Uber

Uber utilizes MicroSurveys within its app to gather feedback from both riders and drivers. Riders might receive a brief survey after completing a trip, asking them to rate the driver and provide comments on the experience. This real-time feedback loop helps Uber address issues promptly and maintain service quality.

Google incorporates MicroSurveys across various products to understand user satisfaction and preferences. For example, within the Gmail interface, users may encounter MicroSurveys asking about the relevance of suggested email categories. Google uses this feedback to refine algorithms and improve user experiences across its ecosystem.

Microsoft

Microsoft employs MicroSurveys to collect feedback on software updates, user interfaces, and the performance of its products. Users of Microsoft Office applications, for instance, may receive brief surveys after using a new feature, helping Microsoft gauge user satisfaction and identify any issues that need addressing.

How to create and roll out MicroSurveys in business

Creating and rolling out MicroSurveys in a business involves several key steps to ensure that the surveys are effective, targeted, and provide valuable insights.

Here’s a guide on how to create and roll out MicroSurveys in a business:

Define objectives

Clearly define the objectives of your MicroSurveys. Understand what specific information you want to gather, whether it’s customer satisfaction, product feedback, employee engagement, or other key metrics.

Identify target audience

Determine the target audience for your MicroSurveys. Consider factors such as customer segments, employee roles, or specific user groups who will provide the most relevant insights based on your objectives.

Choose the right MicroSurvey type

Select the appropriate type of MicroSurvey based on your objectives. Examples include CSAT surveys, NPS surveys, single-question surveys, or emoji-based surveys. Choose a format that aligns with the nature of the information you are seeking.

Craft clear and concise questions

Keep the questions short, clear, and focused. Each question should address a specific aspect related to your objectives. Avoid jargon or complex language that may confuse respondents.

Consider timing and frequency

Determine when and how often you’ll deploy the MicroSurveys. Consider integrating them into key touchpoints such as after customer support interactions, post-purchase, or during specific phases of the employee lifecycle. Be mindful not to over-survey to avoid respondent fatigue.

Utilize targeted triggers

Implement triggers based on user behavior or specific events. For instance, trigger a MicroSurvey after a customer completes a transaction, an employee finishes a training module, or a user interacts with a new feature in your product.

Design user-friendly surveys

Design visually appealing and user-friendly surveys. Use a simple and intuitive interface, and consider incorporating visuals such as icons or images to enhance engagement. Ensure that the surveys are mobile-friendly for users on different devices.

Ensure anonymity and privacy

Clearly communicate to respondents that their feedback is anonymous if applicable. Address privacy concerns and assure participants that their responses will be used for improvement purposes.

Test the surveys

Before rolling out the MicroSurveys, conduct testing to ensure the survey software functions correctly and the questions are clear and understandable. Test across various devices to ensure a seamless experience.

Integrate with existing systems

Integrate MicroSurveys with existing systems or platforms to streamline data collection and analysis. This could involve integrating with customer relationship management (CRM) systems, employee engagement platforms, or other relevant tools.

Roll out gradually

If possible, roll out MicroSurveys gradually to a subset of your target audience. This allows you to gather initial feedback, identify any issues, and make adjustments before a full-scale deployment.

Collect and analyze data

Once the MicroSurveys are live, collect responses and analyze the data regularly. Look for patterns, trends, and areas that require attention. Use the insights to inform business decisions and improvements.

Iterate and optimize

Based on the feedback received, iterate on the MicroSurveys and the processes around them. Continuously optimize the surveys to ensure they remain relevant and effective in capturing valuable insights.

Communicate findings and actions

Communicate the findings from the MicroSurveys to relevant stakeholders. Share the actions taken or improvements made based on the feedback. This demonstrates a commitment to listening to your audience and making positive changes.

Monitor long-term trends

Over time, monitor long-term trends and changes in feedback. Adjust the timing, frequency, or content of the MicroSurveys as needed to address evolving business needs and user expectations.