What is procure-to-pay?

Procure-to-pay is a procurement management process involving the entire process of acquiring goods or services, from the initial procurement (sourcing and selecting suppliers) to the final payment.

Table of contents

In simplified terms, it encompasses all the steps from identifying a need for a product or service to paying for it.

The procure-to-pay process helps organizations manage their spending efficiently, control costs, and maintain transparency in their transactions with suppliers.

It is often facilitated by specialized software systems to streamline and automate the various steps involved.

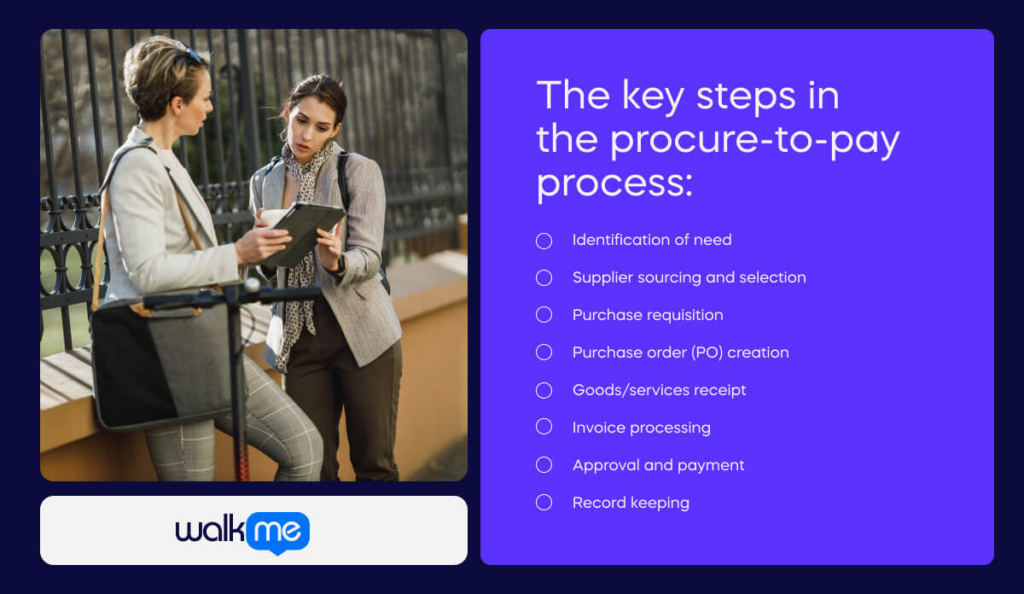

Here’s a breakdown of the key steps in the procure-to-pay process:

Identification of need

This is the initial stage where a department or individual identifies the need for a particular product or service.

Supplier sourcing and selection

Once the need is identified, the organization looks for potential suppliers, evaluates them, and selects the one that best meets the requirements.

Purchase requisition

A formal request is made to the purchasing department to buy the required goods or services. This request is known as a purchase requisition.

Purchase order (PO) creation

The purchasing department generates a purchase order, which is a document that officially requests the supplier to provide the specified goods or services.

Goods/services receipt

Upon receiving the ordered goods or services, the receiving department verifies that they match the specifications mentioned in the purchase order.

Invoice processing

The supplier sends an invoice for the delivered goods or services. The organization reviews the invoice to ensure it matches the purchase order and receipt of goods.

Approval and payment

Once the invoice is verified, it goes through an approval process, and the organization pays the supplier.

Record keeping

All relevant documents, such as purchase orders, receipts, and invoices, are recorded and stored for auditing and accounting purposes.

What is a procure-to-pay system?

A procure-to-pay system is a comprehensive solution or software platform that helps organizations automate and streamline the entire procurement process, from the initial identification of a need to the final payment to suppliers.

A procure-to-pay system aims to enhance efficiency, reduce errors, control costs, and improve visibility into the procurement lifecycle.

This setup is only rising in popularity – according to Verified Market Research, the procurement software market is projected to reach USD 9.5 million by 2028.

Mordor Intelligence has a higher projection, estimating that the market will grow to USD 12.04 billion by 2028.

Here are the key features and components of a typical procure-to-pay system:

Requisition management

Allows users to create and submit purchase requisitions electronically, specifying details of the goods or services required.

Supplier management

Helps manage information about suppliers, including vendor selection, performance evaluation, and relationship management.

Catalog management

Enables the creation and maintenance of catalogs containing products and services available for procurement, streamlining the selection process.

Purchase order (PO) creation

Automates the generation of purchase orders based on approved requisitions, ensuring accuracy and adherence to organizational policies.

Receipt and inspection

Facilitates the receipt of goods or services, allowing users to confirm that the received items match the specifications outlined in the purchase order.

Invoice matching

Compares received invoices with corresponding purchase orders and goods receipts to identify any discrepancies before processing payment.

Invoice approval and payment

Streamlines the approval process for supplier invoices, ensuring proper authorization before initiating payments through various methods such as checks, electronic funds transfers, or credit cards.

Budget monitoring

Helps organizations monitor and control spending by providing real-time visibility into budget allocations and actual expenditures.

Analytics and reporting

Provides reporting tools and analytics to offer insights into procurement activities, supplier performance, and spending trends.

Integration with ERP systems

Integrates with enterprise resource planning (ERP) systems to synchronize procurement data with other financial and operational modules.

Compliance and governance

Ensures procurement activities adhere to internal policies, industry regulations, and compliance standards.

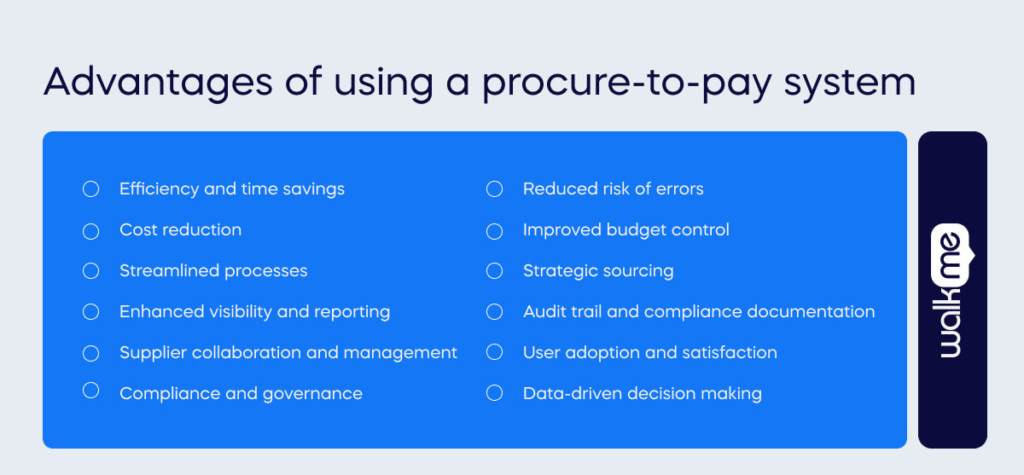

Advantages of using a procure-to-pay system

Using a procure-to-pay system offers numerous advantages for organizations, contributing to increased efficiency, cost savings, and improved control over the procurement process.

Such systems are more important than ever, with The Hackett Group showing companies across the globe are experiencing a 10.6% rise in their procurement requirements.

Here are some key advantages of implementing a procure-to-pay system:

Efficiency and time savings

Automation of procurement processes reduces manual tasks, paperwork, and processing time. This leads to faster order processing, approvals, and payments, allowing employees to focus on more strategic tasks.

Cost reduction

Identifying cost-saving opportunities involves optimizing supplier relationships, negotiating better terms, preventing overpayments or unauthorized purchases, and improving spending visibility, contributing to better budget control.

Streamlined processes

The entire procure-to-pay cycle, from requisition to payment, is streamlined and standardized. This consistency helps eliminate bottlenecks, errors, and delays in the procurement process.

Enhanced visibility and reporting

Real-time visibility into spending patterns, supplier performance, and other key metrics is provided. This visibility enables better decision-making, forecasting, and strategic planning.

Supplier collaboration and management

Better communication and collaboration with suppliers is facilitated. These systems often include features for supplier onboarding, performance tracking, and the ability to negotiate favorable terms.

Compliance and governance

Compliance with organizational policies, industry regulations, and legal requirements is enforced. This ensures that procurement activities adhere to standards, reducing non-compliance risk and associated penalties.

Reduced risk of errors

Automation reduces the likelihood of human errors associated with manual data entry, approval routing, and invoice matching. This improves accuracy in the procurement process, leading to fewer discrepancies and issues.

Improved budget control

Tools for budget monitoring and control are provided. Organizations can set budget limits, track spending against budgets in real-time, and receive alerts when expenditures approach or exceed predefined thresholds.

Strategic sourcing

Features for strategic sourcing and supplier performance evaluation are available. This helps organizations identify the best suppliers, negotiate favorable terms, and build stronger, more strategic supplier relationships.

Audit trail and compliance documentation

A comprehensive audit trail of all procurement activities, including purchase requisitions, purchase orders, goods receipts, and invoices, is maintained. This documentation is valuable for internal and external audits.

User adoption and satisfaction

User-friendly interfaces and streamlined processes contribute to better user adoption. Employees find it easier to navigate the procurement system, leading to increased satisfaction and compliance with organizational procurement policies.

Data-driven decision making

Useful reports and analytics are generated, providing insights into spending patterns, supplier performance, and other key metrics.

This data-driven approach enhances decision-making at various levels within the organization.

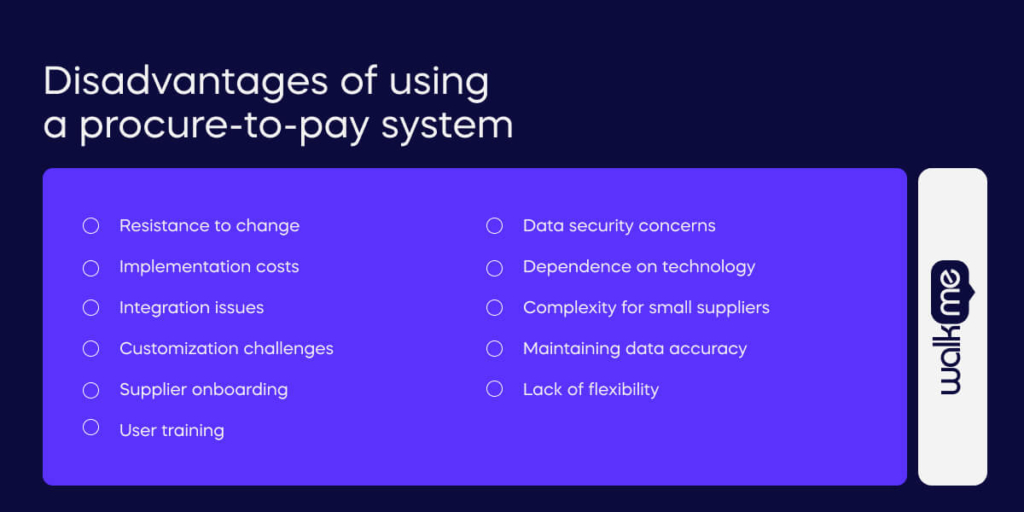

Disadvantages of using a procure-to-pay system

While procure-to-pay systems offer numerous benefits, organizations may encounter potential disadvantages or challenges during implementation or operation. It’s important to be aware of these issues to address them effectively.

Some common disadvantages of procure-to-pay include:

Resistance to change

The transition to automated processes may face resistance to change from employees, particularly those accustomed to manual methods, emphasizing the importance of effective change management for ensuring smooth digital adoption.

Implementation costs

Rolling out a procure-to-pay system can involve significant upfront costs for software, training, and system integration. Small and midsize enterprises, in particular, may find the initial investment challenging.

Integration issues

Integrating procure-to-pay systems with existing enterprise resource planning (ERP) or other systems can be complex. Incompatibility issues may arise, leading to data discrepancies and operational disruptions.

Customization challenges

Organizations with unique or highly customized procurement processes may face challenges configuring a procure-to-pay system to align perfectly with their specific needs, which could require extensive customization efforts.

Supplier onboarding

Onboarding suppliers onto the procure-to-pay platform can be time-consuming. Suppliers may face challenges adapting to new systems, potentially leading to delays or disruptions in the supply chain.

User training

Adequate training is crucial for users to navigate and utilize the procure-to-pay system effectively. Inadequate training can result in errors, inefficiencies, and a slower adoption rate.

Data security concerns

Storing sensitive procurement and financial data in a digital system raises concerns about data security. Organizations must implement robust security measures to protect against cyber threats and unauthorized access.

Dependence on technology

Organizations become heavily dependent on the procure-to-pay system. Technical glitches, system downtimes, or software failures can disrupt operations if contingency plans are not in place.

Complexity for small suppliers

Small suppliers with limited resources may find it challenging to adapt to the technological requirements of the procure-to-pay system. This can affect the inclusion of diverse suppliers in the procurement process.

Maintaining data accuracy

Despite automation, maintaining accurate data throughout the procurement process requires continuous effort. Errors in data entry or system updates can lead to discrepancies and affect decision-making.

Lack of flexibility

Some procure-to-pay systems may lack the flexibility to accommodate changes in procurement processes or adapt to evolving business needs. This rigidity can limit an organization’s agility.

Source-to-pay vs procure-to-pay

Source-to-pay and procure-to-pay are two closely related but distinct processes within the broader procurement and supply chain management domain.

Here’s a breakdown of the key differences:

| Source-to-pay | Procure-to-pay |

| Encompasses the entire procurement lifecycle, starting from the initial identification of a need for goods or services (sourcing) to the final payment to suppliers. | A subset of the source-to-pay process, specifically focusing on the operational aspects of procurement, starting from the requisition of goods or services to the payment. |

| Strategic in nature, involving activities like supplier selection, contract negotiation, and relationship management. | Dealing with the daily processes of requisitioning, ordering, receiving, and paying. |

| Supplier relationship management is a key component of the process. | Supplier relationship management is a less emphasized aspect of the process. |

Procure-to-pay vs order-to-cash (P2P vs O2C)

Procure-to-pay (P2P) and order-to-cash (O2C) are two distinct business processes organizations use to manage different operations.

Both processes span the entire lifecycle of a transaction, from initiation to completion, but they focus on different aspects of the business.

Let’s explore each process in more detail:

| Procure-to-pay | Order-to-cash |

| Focuses on the procurement of goods and services needed by the organization. | Centered around fulfilling customer orders and receiving payment for the products or services provided. |

| Initiated by an internal need for goods or services within the organization. | Initiated by an external customer placing an order for products or services. |

| Flows from the organization to external vendors or suppliers. | Flows from the external customer to the organization. |

| Key stages are: Purchase requisitionVendor selection and purchase order creationGoods or services receiptInvoice processingPayment to vendors | Key stages are: Order placementOrder processingPicking and packingDelivery to the customerInvoicingReceipt of payment |

Procure-to-pay vs record-to-report vs quote-to-cash (P2P vs R2R vs Q2C)

Procure-to-pay (P2P), record-to-report (R2R), and quote-to-cash (Q2C) are three different business processes that represent various stages in the overall lifecycle of a transaction within an organization.

Each process serves a distinct purpose and encompasses different activities. Here’s a brief overview of each:

| Procure-to-pay | Record-to-report | Quote-to-cash |

| Focuses on procurement and payment to vendors. | Covers the overall financial recording and reporting process. | Encompasses the entire customer engagement cycle from generating a quote to receiving payment. |

| Key stages are: Purchase requisitionVendor selection and purchase order creationGoods or services receiptInvoice processingPayment to vendors | Key stages are: Data entry and journalizingGeneral ledger maintenanceFinancial reportingReconciliation | Key stages are: Quote generationOrder placement and processingDelivery and invoicingPayment |

| Triggered by an internal need for goods or services within the organization. | Initiated by various financial transactions within the organization on an ongoing basis. | Triggered by a customer expressing interest in purchasing products or services from the organization. |

| Flows from the organization to external vendors or suppliers. | Internal flow within the organization focused on maintaining financial records and reporting. | Flows from the external customer to the organization. |

| The objective is to procure necessary goods and services for the organization efficiently and cost-effectively. | Aims to ensure the integrity and accuracy of financial records and generate meaningful financial reports for internal and external stakeholders. | Focused on providing customers with the products or services they have ordered and collecting payment for those transactions. |

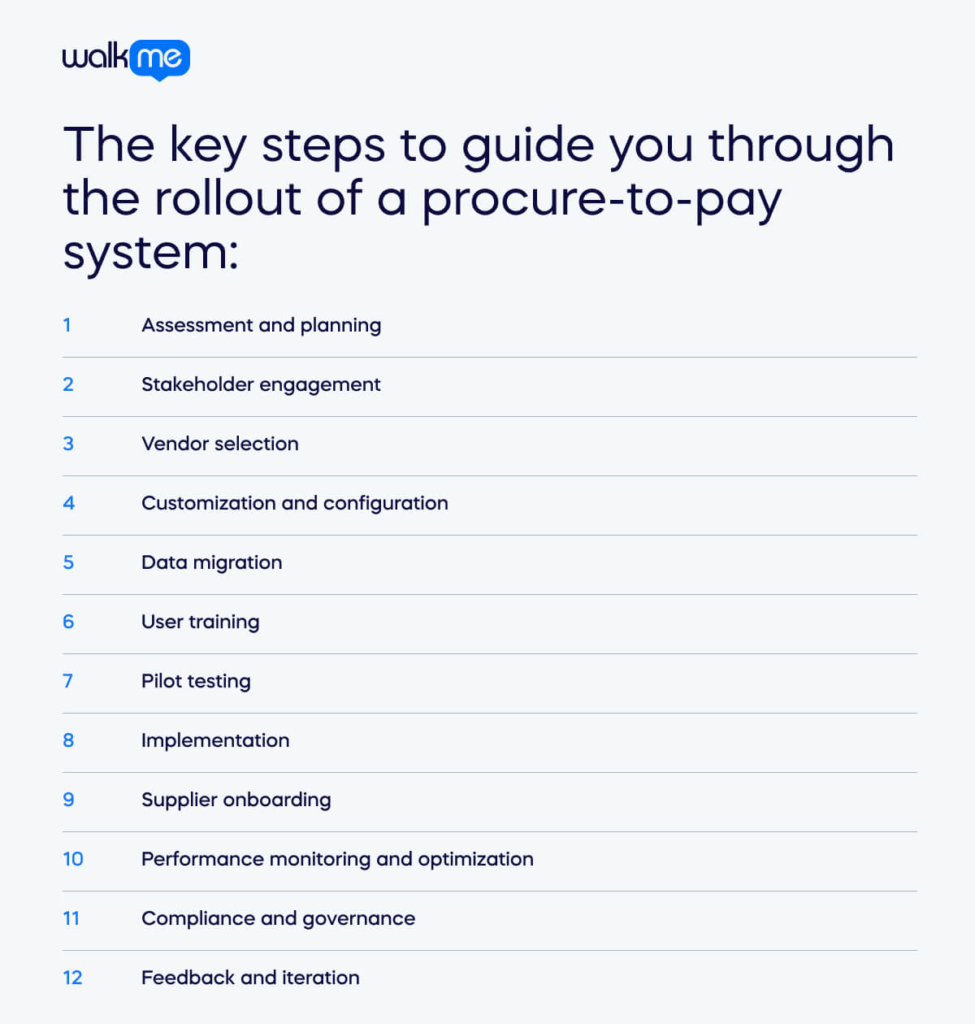

How to roll out a procure-to-pay system

Rolling out a procure-to-pay system involves a strategic and well-planned implementation process.

Here are the key steps to guide you through the rollout of a procure-to-pay system:

Assessment and planning

Conduct a thorough analysis of your existing procurement processes to identify areas that can be improved through automation.

Clearly define the objectives you aim to achieve with a procure-to-pay system, such as cost savings, process efficiency, and better compliance.

Stakeholder engagement

Determine the key stakeholders involved in the procurement process, including departments, users, and suppliers.

Develop a communication plan to inform stakeholders about the upcoming changes, the benefits of the new system, and their roles in the implementation process.

Vendor selection

Research and evaluate different procure-to-pay solutions based on your organization’s needs, scalability, and budget.

Choose a procure-to-pay system that aligns with your requirements. Consider factors such as user-friendliness, integration capabilities, and support services.

Customization and configuration

Work with the chosen vendor to customize the procure-to-pay system to fit your organization’s specific requirements if needed.

Configure the system to align with your procurement workflows, approval processes, and organizational hierarchy.

Data migration

Cleanse and organize existing procurement data to ensure accuracy before migration.

Develop a plan for migrating data from the old system (or manual records) to the new procure-to-pay system.

User training

Develop a comprehensive training program for users at various levels within the organization.

Include training on system navigation, entering requisitions, approving orders, and using other features. Create user-friendly training materials like manuals, video tutorials, and FAQs.

Pilot testing

Choose a group of pilot users or a specific department to test the procure-to-pay system in a controlled environment.

Collect feedback from pilot users to identify any issues, improvements, or additional training needs.

Implementation

Roll out the procure-to-pay system in phases rather than all at once. Start with a small group or department, monitor the performance, and gradually expand.

Provide ongoing support during the rollout phase and address any issues promptly.

Supplier onboarding

Inform suppliers about the new procure-to-pay system and provide guidance on the onboarding process.

Offer assistance to suppliers as they adapt to the new system, addressing any questions or concerns.

Performance monitoring and optimization

Establish key performance indicators (KPIs), such as cycle time reduction, cost savings, and user satisfaction, to measure the success of the procure-to-pay system.

Continuously monitor system performance, gather user feedback, and implement improvements to optimize the procure-to-pay process over time.

Compliance and governance

Ensure that users adhere to organizational procurement policies and that the procure-to-pay system supports compliance.

Conduct regular audits to assess the system’s effectiveness and identify areas for improvement.

Feedback and iteration

Establish a feedback mechanism for users to provide ongoing input and suggestions.

Use the feedback received to make iterative improvements to the system and address evolving business needs.